Harvest-Related Transport Of Forest Products Application Form

ADVERTISEMENT

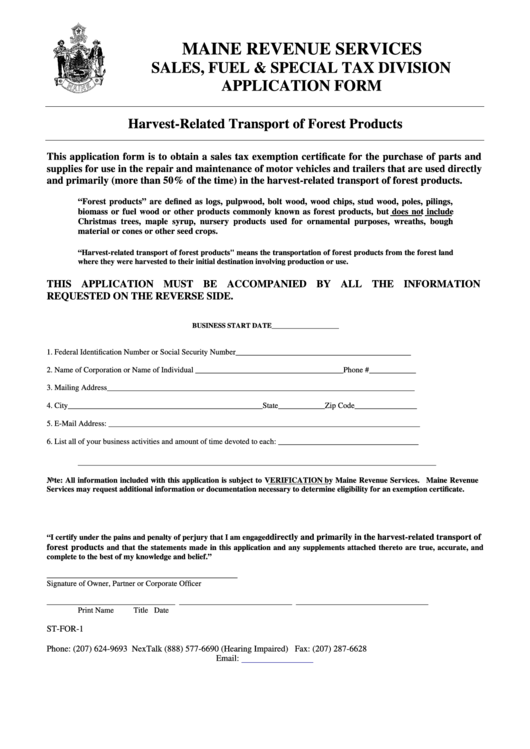

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

APPLICATION FORM

Harvest-Related Transport of Forest Products

This application form is to obtain a sales tax exemption certificate for the purchase of parts and

supplies for use in the repair and maintenance of motor vehicles and trailers that are used directly

and primarily (more than 50% of the time) in the harvest-related transport of forest products.

“Forest products” are defined as logs, pulpwood, bolt wood, wood chips, stud wood, poles, pilings,

biomass or fuel wood or other products commonly known as forest products, but does not include

Christmas trees, maple syrup, nursery products used for ornamental purposes, wreaths, bough

material or cones or other seed crops.

“Harvest-related transport of forest products" means the transportation of forest products from the forest land

where they were harvested to their initial destination involving production or use.

THIS APPLICATION MUST BE ACCOMPANIED BY ALL THE INFORMATION

REQUESTED ON THE REVERSE SIDE.

BUSINESS START DATE___________________

1. Federal Identification Number or Social Security Number_____________________________________________

2. Name of Corporation or Name of Individual ______________________________________Phone #____________

3. Mailing Address_______________________________________________________________________________

4. City__________________________________________________State____________Zip Code________________

5. E-Mail Address: ________________________________________________________________________________

6. List all of your business activities and amount of time devoted to each: ____________________________________

____________________________________________________________________________________________

Note: All information included with this application is subject to VERIFICATION by Maine Revenue Services. Maine Revenue

Services may request additional information or documentation necessary to determine eligibility for an exemption certificate.

directly and primarily in the harvest-related transport of

“I certify under the pains and penalty of perjury that I am engaged

forest products

and that the statements made in this application and any supplements attached thereto are true, accurate, and

complete to the best of my knowledge and belief.”

_________________________________________________

Signature of Owner, Partner or Corporate Officer

_________________________________

_____________________________

__________________________________

Print Name

Title

Date

ST-FOR-1

Phone: (207) 624-9693

NexTalk (888) 577-6690 (Hearing Impaired)

Fax: (207) 287-6628

Email:

salestax@maine.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2