Form W1 7 - Employer'S Withholding Form - City Of Reading, Ohio

ADVERTISEMENT

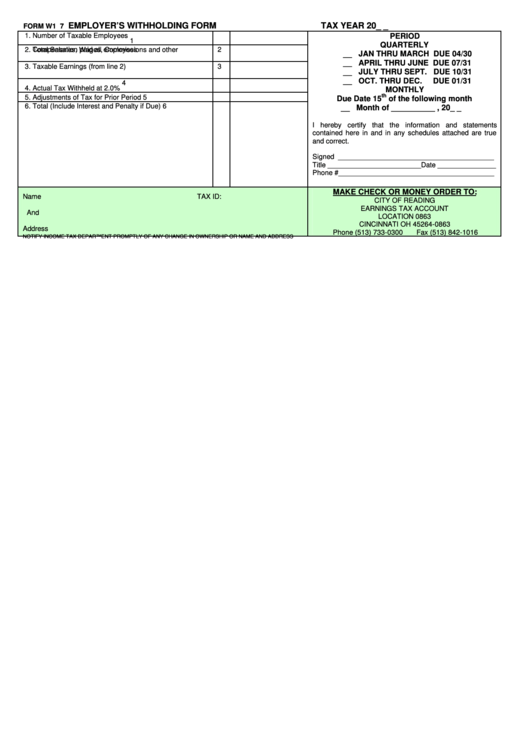

EMPLOYER’S WITHHOLDING FORM

TAX YEAR 20_ _

FORM W1 7

1. Number of Taxable Employees

PERIOD

1

QUARTERLY

2. Total Salaries, Wages, Commissions and other

__ JAN THRU MARCH DUE 04/30

Compensation paid all employees

2

__ APRIL THRU JUNE DUE 07/31

__ JULY THRU SEPT. DUE 10/31

3. Taxable Earnings (from line 2)

3

__ OCT. THRU DEC.

DUE 01/31

4

4. Actual Tax Withheld at 2.0%

MONTHLY

th

5. Adjustments of Tax for Prior Period

5

Due Date 15

of the following month

6. Total (Include Interest and Penalty if Due)

6

__ Month of __________ , 20_ _

I hereby certify that the information and statements

contained here in and in any schedules attached are true

and correct.

Signed ________________________________________

Title ________________________Date _______________

Phone #________________________________________

MAKE CHECK OR MONEY ORDER TO:

Name

TAX ID:

CITY OF READING

EARNINGS TAX ACCOUNT

And

LOCATION 0863

CINCINNATI OH 45264-0863

Address

Phone (513) 733-0300

Fax (513) 842-1016

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1