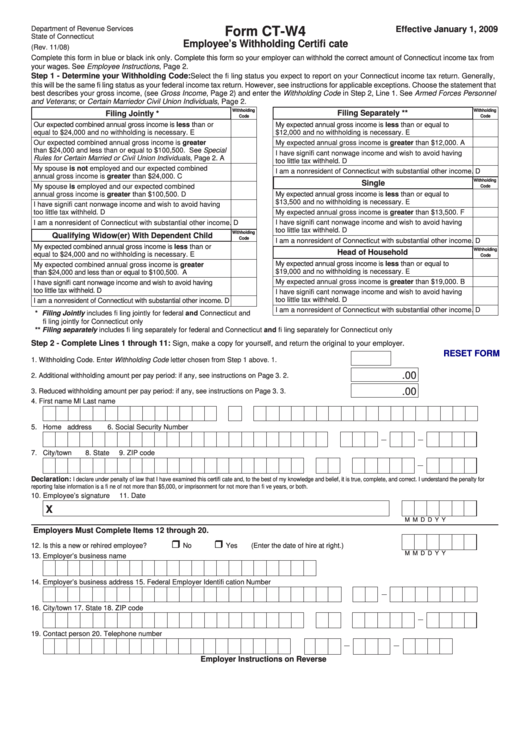

Department of Revenue Services

Form CT-W4

Effective January 1, 2009

State of Connecticut

Employee’s Withholding Certifi cate

(Rev. 11/08)

Complete this form in blue or black ink only. Complete this form so your employer can withhold the correct amount of Connecticut income tax from

your wages. See Employee Instructions, Page 2.

Step 1 - Determine your Withholding Code:

Select the fi ling status you expect to report on your Connecticut income tax return. Generally,

this will be the same fi ling status as your federal income tax return. However, see instructions for applicable exceptions. Choose the statement that

best describes your gross income, (see Gross Income, Page 2) and enter the Withholding Code in Step 2, Line 1. See Armed Forces Personnel

and Veterans; or Certain Married or Civil Union Individuals, Page 2.

Withholding

Withholding

Filing Separately **

Filing Jointly *

Code

Code

Our expected combined annual gross income is less than or

My expected annual gross income is less than or equal to

equal to $24,000 and no withholding is necessary.

E

$12,000 and no withholding is necessary.

E

Our expected combined annual gross income is greater

My expected annual gross income is greater than $12,000.

A

than $24,000 and less than or equal to $100,500. See Special

I have signifi cant nonwage income and wish to avoid having

Rules for Certain Married or Civil Union Individuals, Page 2.

A

too little tax withheld.

D

My spouse is not employed and our expected combined

I am a nonresident of Connecticut with substantial other income.

D

annual gross income is greater than $24,000.

C

Withholding

Single

My spouse is employed and our expected combined

Code

annual gross income is greater than $100,500.

D

My expected annual gross income is less than or equal to

$13,500 and no withholding is necessary.

E

I have signifi cant nonwage income and wish to avoid having

too little tax withheld.

D

My expected annual gross income is greater than $13,500.

F

I am a nonresident of Connecticut with substantial other income.

D

I have signifi cant nonwage income and wish to avoid having

too little tax withheld.

D

Withholding

Qualifying Widow(er) With Dependent Child

Code

I am a nonresident of Connecticut with substantial other income.

D

My expected combined annual gross income is less than or

Withholding

Head of Household

equal to $24,000 and no withholding is necessary.

E

Code

My expected annual gross income is less than or equal to

My expected combined annual gross income is greater

$19,000 and no withholding is necessary.

E

than $24,000 and less than or equal to $100,500.

A

My expected annual gross income is greater than $19,000.

B

I have signifi cant nonwage income and wish to avoid having

too little tax withheld.

D

I have signifi cant nonwage income and wish to avoid having

too little tax withheld.

D

I am a nonresident of Connecticut with substantial other income.

D

I am a nonresident of Connecticut with substantial other income.

D

* Filing Jointly includes fi ling jointly for federal and Connecticut and

fi ling jointly for Connecticut only

** Filing separately includes fi ling separately for federal and Connecticut and fi ling separately for Connecticut only

Step 2 - Complete Lines 1 through 11:

Sign, make a copy for yourself, and return the original to your employer.

RESET FORM

1. Withholding Code. Enter Withholding Code letter chosen from Step 1 above.

1.

.00

2. Additional withholding amount per pay period: if any, see instructions on Page 3.

2.

.00

3. Reduced withholding amount per pay period: if any, see instructions on Page 3.

3.

4. First name

Ml

Last name

5. Home address

6. Social Security Number

7. City/town

8. State

9. ZIP code

Declaration:

I declare under penalty of law that I have examined this certifi cate and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for

reporting false information is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both.

10. Employee’s signature

11. Date

X

M

M

D

D

Y

Y

Employers Must Complete Items 12 through 20.

12. Is this a new or rehired employee?

No

Yes

(Enter the date of hire at right.)

M

M

D

D

Y

Y

13. Employer’s business name

14. Employer’s business address

15. Federal Employer Identifi cation Number

16. City/town

17. State

18. ZIP code

19. Contact person

20. Telephone number

Employer Instructions on Reverse

1

1