Sales And Use Tax Resale Certificate Template - State Of Maryland Comptroller'S Office

ADVERTISEMENT

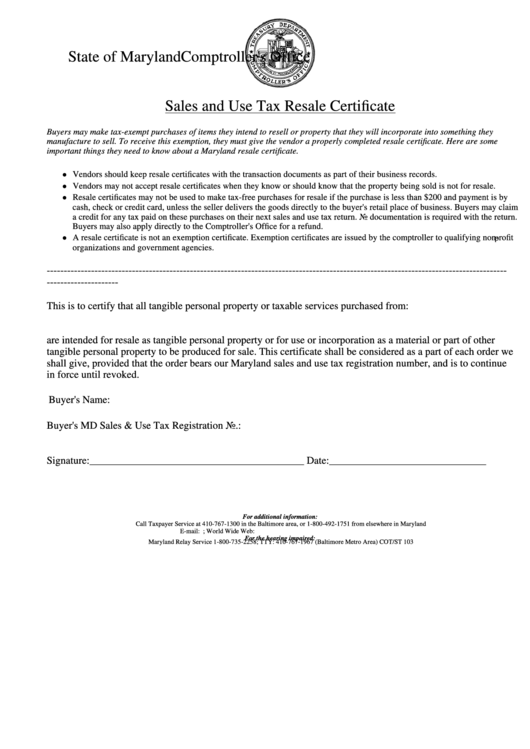

State of Maryland

Comptroller's Office

Sales and Use Tax Resale Certificate

Buyers may make tax-exempt purchases of items they intend to resell or property that they will incorporate into something they

manufacture to sell. To receive this exemption, they must give the vendor a properly completed resale certificate. Here are some

important things they need to know about a Maryland resale certificate.

Vendors should keep resale certificates with the transaction documents as part of their business records.

Vendors may not accept resale certificates when they know or should know that the property being sold is not for resale.

Resale certificates may not be used to make tax-free purchases for resale if the purchase is less than $200 and payment is by

cash, check or credit card, unless the seller delivers the goods directly to the buyer's retail place of business. Buyers may claim

a credit for any tax paid on these purchases on their next sales and use tax return. No documentation is required with the return.

Buyers may also apply directly to the Comptroller's Office for a refund.

A resale certificate is not an exemption certificate. Exemption certificates are issued by the comptroller to qualifying non-profit

organizations and government agencies.

---------------------------------------------------------------------------------------------------------------------------------------

---------------------

This is to certify that all tangible personal property or taxable services purchased from:

are intended for resale as tangible personal property or for use or incorporation as a material or part of other

tangible personal property to be produced for sale. This certificate shall be considered as a part of each order we

shall give, provided that the order bears our Maryland sales and use tax registration number, and is to continue

in force until revoked.

Buyer's Name:

Buyer's MD Sales & Use Tax Registration No.:

Signature:_________________________________________ Date:______________________________

For additional information:

Call Taxpayer Service at 410-767-1300 in the Baltimore area, or 1-800-492-1751 from elsewhere in Maryland

E-mail: sut@comp.state.md.us; World Wide Web:

For the hearing impaired:

Maryland Relay Service 1-800-735-2258; TTY: 410-767-1967 (Baltimore Metro Area) COT/ST 103

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1