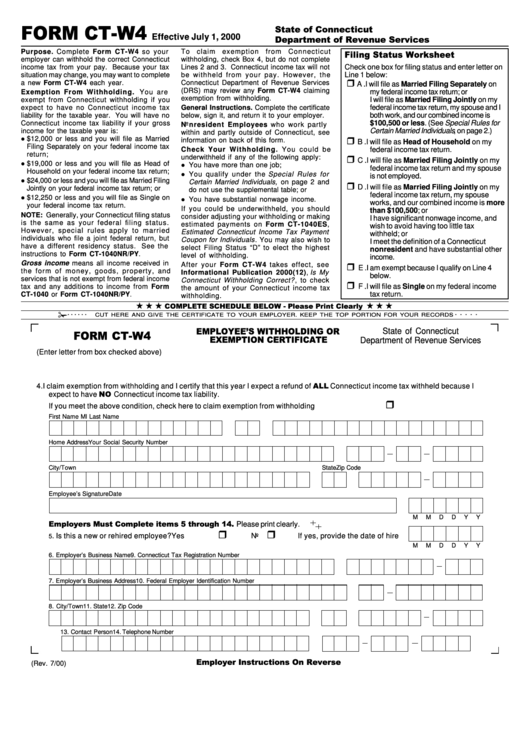

Form Ct-W4 - Employees Withholding Or Exemption Certificate

ADVERTISEMENT

FORM CT-W4

State of Connecticut

Effective July 1, 2000

Department of Revenue Services

Purpose. Complete Form CT-W4 so your

To claim exemption from Connecticut

Filing Status Worksheet

employer can withhold the correct Connecticut

withholding, check Box 4, but do not complete

income tax from your pay. Because your tax

Lines 2 and 3. Connecticut income tax will not

Check one box for filing status and enter letter on

situation may change, you may want to complete

be withheld from your pay. However, the

Line 1 below:

r

a new Form CT-W4 each year.

Connecticut Department of Revenue Services

A . I will file as Married Filing Separately on

(DRS) may review any Form CT-W4 claiming

Exemption From Withholding. You are

my federal income tax return; or

exemption from withholding.

exempt from Connecticut withholding if you

I will file as Married Filing Jointly on my

expect to have no Connecticut income tax

General Instructions. Complete the certificate

federal income tax return, my spouse and I

both work, and our combined income is

liability for the taxable year. You will have no

below, sign it, and return it to your employer.

Connecticut income tax liability if your gross

$100,500 or less. (See Special Rules for

Nonresident Employees who work partly

income for the taxable year is:

Certain Married Individuals , on page 2.)

within and partly outside of Connecticut, see

r

l

$12,000 or less and you will file as Married

information on back of this form.

B . I will file as Head of Household on my

Filing Separately on your federal income tax

Check Your Withholding. You could be

federal income tax return.

return;

r

underwithheld if any of the following apply:

C . I will file as Married Filing Jointly on my

l

$19,000 or less and you will file as Head of

l

You have more than one job;

federal income tax return and my spouse

Household on your federal income tax return;

You qualify under the Special Rules for

l

is not employed.

l

$24,000 or less and you will file as Married Filing

Certain Married Individuals, on page 2 and

r

D . I will file as Married Filing Jointly on my

Jointly on your federal income tax return; or

do not use the supplemental table; or

federal income tax return, my spouse

l

$12,250 or less and you will file as Single on

l

You have substantial nonwage income.

works, and our combined income is more

your federal income tax return.

If you could be underwithheld, you should

than $100,500; or

NOTE: Generally, your Connecticut filing status

consider adjusting your withholding or making

I have significant nonwage income, and

is the same as your federal filing status.

estimated payments on Form CT-1040ES,

wish to avoid having too little tax

However, special rules apply to married

Estimated Connecticut Income Tax Payment

withheld; or

individuals who file a joint federal return, but

Coupon for Individuals . You may also wish to

I meet the definition of a Connecticut

have a different residency status. See the

select Filing Status “D” to elect the highest

nonresident and have substantial other

instructions to Form CT-1040NR/PY.

level of withholding.

income.

Gross income means all income received in

r

After your Form CT-W4 takes effect, see

E . I am exempt because I qualify on Line 4

the form of money, goods, property, and

Informational Publication 2000(12), Is My

below.

services that is not exempt from federal income

Connecticut Withholding Correct? , to check

r

F . I will file as Single on my federal income

tax and any additions to income from Form

the amount of your Connecticut income tax

CT-1040 or Form CT-1040NR/PY.

tax return.

withholding.

COMPLETE SCHEDULE BELOW - Please Print Clearly

- - - - - -

- - - - - -

CUT HERE AND GIVE THE CERTIFICATE TO YOUR EMPLOYER. KEEP THE TOP PORTION FOR YOUR RECORDS

EMPLOYEE’S WITHHOLDING OR

State of Connecticut

FORM CT-W4

EXEMPTION CERTIFICATE

Department of Revenue Services

1. Filing Status (Enter letter from box checked above) ............................................................................. 1. ___________________________

2. Additional withholding amount per pay period ....................................................................................... 2. ___________________________

3. Reductional withholding amount per pay period .................................................................................... 3. ___________________________

4. I claim exemption from withholding and I certify that this year I expect a refund of ALL Connecticut income tax withheld because I

expect to have NO Connecticut income tax liability.

r

If you meet the above condition, check here to claim exemption from withholding ............................. 4.

First Name

Ml

Last Name

Home Address

Your Social Security Number

City/Town

State

Zip Code

Employee’s Signature

Date

M

M

D

D

Y

Y

Employers Must Complete items 5 through 14. Please print clearly.

r

r

. Is this a new or rehired employee?

Yes

No

If yes, provide the date of hire

5

M

M

D

D

Y

Y

6. Employer’s Business Name

9. Connecticut Tax Registration Number

7. Employer’s Business Address

10. Federal Employer Identification Number

8. City/Town

11. State

12. Zip Code

13. Contact Person

14. Telephone Number

Employer Instructions On Reverse

(Rev. 7/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1