Form In-114 - Individual Income Estimated Tax Payment Vouchers With Instructions - 2006

ADVERTISEMENT

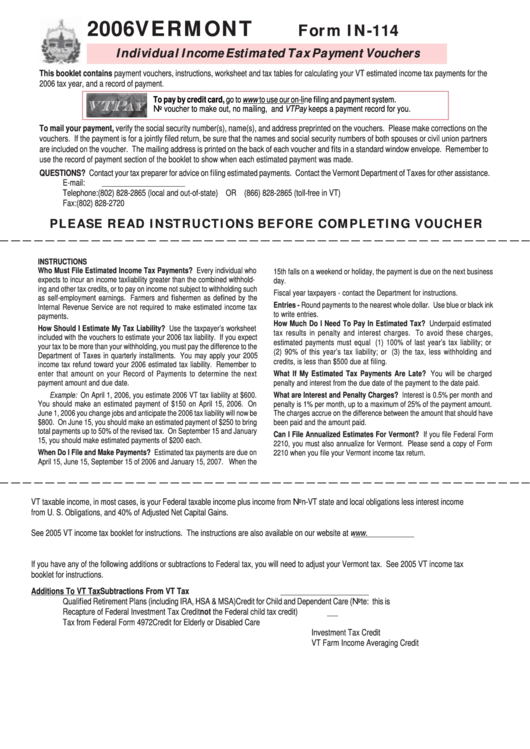

2006

VERMONT

Form IN-114

Individual Income Estimated Tax Payment Vouchers

This booklet contains payment vouchers, instructions, worksheet and tax tables for calculating your VT estimated income tax payments for the

2006 tax year, and a record of payment.

To pay by credit card, go to to use our on-line filing and payment system.

No voucher to make out, no mailing, and VTPay keeps a payment record for you.

To mail your payment, verify the social security number(s), name(s), and address preprinted on the vouchers. Please make corrections on the

vouchers. If the payment is for a jointly filed return, be sure that the names and social security numbers of both spouses or civil union partners

are included on the voucher. The mailing address is printed on the back of each voucher and fits in a standard window envelope. Remember to

use the record of payment section of the booklet to show when each estimated payment was made.

QUESTIONS? Contact your tax preparer for advice on filing estimated payments. Contact the Vermont Department of Taxes for other assistance.

E-mail:

indincome@tax.state.vt.us

Telephone: (802) 828-2865 (local and out-of-state) OR (866) 828-2865 (toll-free in VT)

Fax:

(802) 828-2720

PLEASE READ INSTRUCTIONS BEFORE COMPLETING VOUCHER

INSTRUCTIONS

Who Must File Estimated Income Tax Payments? Every individual who

15th falls on a weekend or holiday, the payment is due on the next business

expects to incur an income tax liability greater than the combined withhold-

day.

ing and other tax credits, or to pay on income not subject to withholding such

Fiscal year taxpayers - contact the Department for instructions.

as self-employment earnings. Farmers and fishermen as defined by the

Entries - Round payments to the nearest whole dollar. Use blue or black ink

Internal Revenue Service are not required to make estimated income tax

to write entries.

payments.

How Much Do I Need To Pay In Estimated Tax? Underpaid estimated

How Should I Estimate My Tax Liability? Use the taxpayer’s worksheet

tax results in penalty and interest charges. To avoid these charges,

included with the vouchers to estimate your 2006 tax liability. If you expect

estimated payments must equal (1) 100% of last year’s tax liability; or

your tax to be more than your withholding, you must pay the difference to the

(2) 90% of this year’s tax liability; or (3) the tax, less withholding and

Department of Taxes in quarterly installments. You may apply your 2005

credits, is less than $500 due at filing.

income tax refund toward your 2006 estimated tax liability. Remember to

enter that amount on your Record of Payments to determine the next

What If My Estimated Tax Payments Are Late? You will be charged

payment amount and due date.

penalty and interest from the due date of the payment to the date paid.

Example: On April 1, 2006, you estimate 2006 VT tax liability at $600.

What are Interest and Penalty Charges? Interest is 0.5% per month and

You should make an estimated payment of $150 on April 15, 2006. On

penalty is 1% per month, up to a maximum of 25% of the payment amount.

June 1, 2006 you change jobs and anticipate the 2006 tax liability will now be

The charges accrue on the difference between the amount that should have

$800. On June 15, you should make an estimated payment of $250 to bring

been paid and the amount paid.

total payments up to 50% of the revised tax. On September 15 and January

Can I File Annualized Estimates For Vermont? If you file Federal Form

15, you should make estimated payments of $200 each.

2210, you must also annualize for Vermont. Please send a copy of Form

When Do I File and Make Payments? Estimated tax payments are due on

2210 when you file your Vermont income tax return.

April 15, June 15, September 15 of 2006 and January 15, 2007. When the

VT taxable income, in most cases, is your Federal taxable income plus income from Non-VT state and local obligations less interest income

from U. S. Obligations, and 40% of Adjusted Net Capital Gains.

See 2005 VT income tax booklet for instructions. The instructions are also available on our website at .

If you have any of the following additions or subtractions to Federal tax, you will need to adjust your Vermont tax. See 2005 VT income tax

booklet for instructions.

Additions To VT Tax

Subtractions From VT Tax

Qualified Retirement Plans (including IRA, HSA & MSA)

Credit for Child and Dependent Care (Note: this is

Recapture of Federal Investment Tax Credit

not the Federal child tax credit)

Tax from Federal Form 4972

Credit for Elderly or Disabled Care

Investment Tax Credit

VT Farm Income Averaging Credit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3