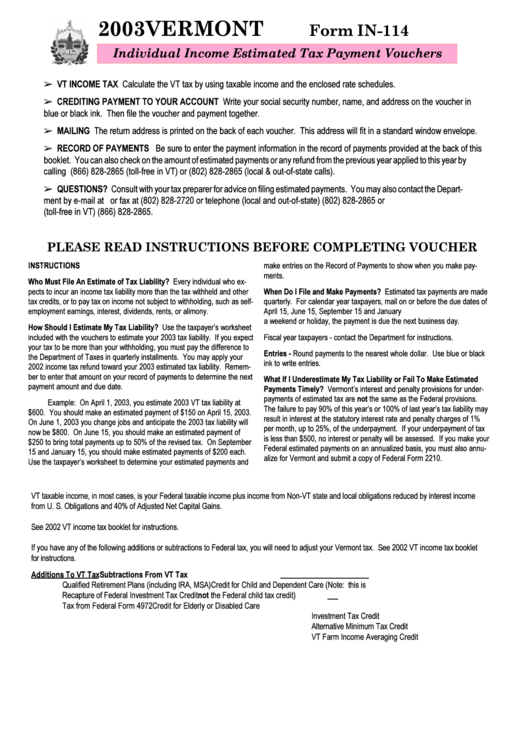

Form In-114 - Individual Income Estimated Tax Payment Voucher - 2003

ADVERTISEMENT

2003

VERMONT

Form IN-114

Individual Income Estimated Tax Payment Vouchers

% VT INCOME TAX Calculate the VT tax by using taxable income and the enclosed rate schedules.

% CREDITING PAYMENT TO YOUR ACCOUNT Write your social security number, name, and address on the voucher in

blue or black ink. Then file the voucher and payment together.

% MAILING The return address is printed on the back of each voucher. This address will fit in a standard window envelope.

% RECORD OF PAYMENTS Be sure to enter the payment information in the record of payments provided at the back of this

booklet. You can also check on the amount of estimated payments or any refund from the previous year applied to this year by

calling (866) 828-2865 (toll-free in VT) or (802) 828-2865 (local & out-of-state calls).

% QUESTIONS? Consult with your tax preparer for advice on filing estimated payments. You may also contact the Depart-

ment by e-mail at vttaxdept@tax.state.vt.us or fax at (802) 828-2720 or telephone (local and out-of-state) (802) 828-2865 or

(toll-free in VT) (866) 828-2865.

PLEASE READ INSTRUCTIONS BEFORE COMPLETING VOUCHER

INSTRUCTIONS

Who Must File An Estimate of Tax Liability?

When Do I File and Make Payments?

How Should I Estimate My Tax Liability?

Entries -

What If I Underestimate My Tax Liability or Fail To Make Estimated

Payments Timely?

not

Additions To VT Tax

Subtractions From VT Tax

not

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3