Instructions

Reset Form

Print Form

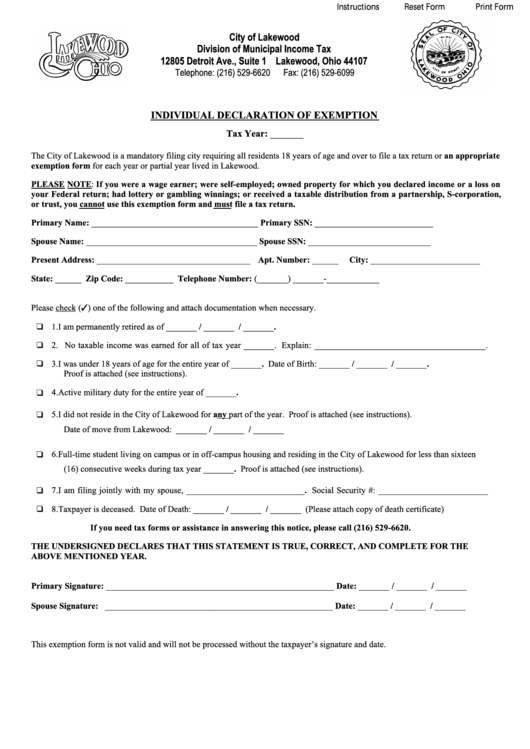

City of Lakewood

Division of Municipal Income Tax

12805 Detroit Ave., Suite 1 Lakewood, Ohio 44107

Telephone: (216) 529-6620

Fax: (216) 529-6099

INDIVIDUAL DECLARATION OF EXEMPTION

Tax Year: _______

The City of Lakewood is a mandatory filing city requiring all residents 18 years of age and over to file a tax return or an appropriate

exemption form for each year or partial year lived in Lakewood.

PLEASE NOTE: If you were a wage earner; were self-employed; owned property for which you declared income or a loss on

your Federal return; had lottery or gambling winnings; or received a taxable distribution from a partnership, S-corporation,

or trust, you cannot use this exemption form and must file a tax return.

Primary Name: ______________________________________

Primary SSN: ___________________________

Spouse Name: _______________________________________

Spouse SSN: ____________________________

Present Address: ___________________________________ Apt. Number: ______

City: _________________________

State: ______

Zip Code: ___________

Telephone Number: (_______) _______-____________

Please check (✓) one of the following and attach documentation when necessary.

❑

1. I am permanently retired as of _______ / _______ / _______.

❑

2. No taxable income was earned for all of tax year _______. Explain: _______________________________________.

❑

3. I was under 18 years of age for the entire year of _______. Date of Birth: _______ / _______ / _______.

Proof is attached (see instructions).

❑

4. Active military duty for the entire year of _______.

❑

5. I did not reside in the City of Lakewood for any part of the year. Proof is attached (see instructions).

Date of move from Lakewood: _______ / _______ / _______

❑

6. Full-time student living on campus or in off-campus housing and residing in the City of Lakewood for less than sixteen

(16) consecutive weeks during tax year _______. Proof is attached (see instructions).

❑

7. I am filing jointly with my spouse, ___________________________. Social Security #: _________________________

❑

8. Taxpayer is deceased. Date of Death: _______ / _______ / _______ (Please attach copy of death certificate)

If you need tax forms or assistance in answering this notice, please call (216) 529-6620.

THE UNDERSIGNED DECLARES THAT THIS STATEMENT IS TRUE, CORRECT, AND COMPLETE FOR THE

ABOVE MENTIONED YEAR.

Primary Signature: ____________________________________________________ Date: _______ / _______ / _______

Spouse Signature: ____________________________________________________ Date: _______ / _______ / _______

This exemption form is not valid and will not be processed without the taxpayer’s signature and date.

1

1 2

2