Print Instructions

Back to Page 1

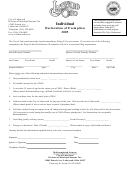

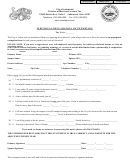

INSTRUCTIONS FOR FORM DECLARATION OF EXEMPTION

If you were a wage earner; were self-employed; owned property for which you declared income or a loss on your Federal

return; had lottery or gambling winnings; or received a taxable distribution from a partnership, S-corporation, or trust, you

are not exempt from the mandatory filing requirement and may not use this form.

1.

If you were retired for the entire year in question; received only pension income, social security income, dividends, or interest

income; and do not anticipate deriving any income taxable to Lakewood, indicate so by checking (✓) option 1 on the front of

this page. Please also fill in the date of your retirement. This exemption is for one year only, and additional declarations

must be completed for each subsequent applicable year.

2.

If you are not retired but did not receive any income taxable to Lakewood for the year in question, indicate so by

checking (✓) option 2 on the front of this page. Please also fill in the applicable tax year and a short explanation of the

circumstances (e.g. disability, unemployment, no employment, etc.). This exemption is for one year only, and additional

declarations must be completed for each subsequent applicable year.

3.

If you were under the age of eighteen (18) for the entire year in question, indicate so by filling in your date of birth. This

exemption must be accompanied by proof of age (e.g. a photocopy of a birth certificate or driver’s license).

NOTE: Parents of minors – If your child has received earned income and is under the age of eighteen (18), please

check (✓) option 3 on the front of this page, note the birth date in the applicable space, and submit the above-

mentioned documentation.

4.

If you were an active member of the U.S. Armed Forces for the entire year in question, please check (✓) option 4 on the front

of this page. Documentation verifying that the dates of active duty status were during the tax year in question must be

attached. This exemption is for one year only, and additional declarations must be completed for each subsequent

applicable year.

5.

If you did not reside in the City of Lakewood at all during the year in question, indicate so by checking (✓) option 5 on the

front of this page. Please also fill in the date of your move into or out of Lakewood. Please attach proof of your move (e.g. a

copy of your non-Lakewood municipal income tax return filed with your resident municipality during the year in question, a

lease/rental agreement or closing statement confirming the claimed move-in or move-out date, or proof of an address change

with the U.S. Postal Service).

6.

If you were domiciled in the City of Lakewood but attended an accredited college or university for the entire year in question,

lived on campus or in off-campus housing during the year in question, and did not reside in the City of Lakewood for more

than sixteen (16) consecutive weeks during the year in question, indicate so by checking (✓) option 6 on the front of this

page. Proof must be submitted with this form and may consist of grade transcripts, registration forms, or billing statements.

Be sure to include proof for each quarter or semester of the tax year. This exemption is for one year only, and additional

declarations must be completed for each subsequent applicable year.

7.

If you filed jointly with your spouse, indicate so by checking (✓) option 7 on the front of this page. Please also fill in the

name of your spouse and provide his/her social security number.

NOTE: If a married couple elects to file separately in a subsequent year, it shall be the responsibility of each spouse to

obtain and file a return with our office.

8. If the taxpayer in question is deceased, the executor of the taxpayer’s estate should indicate so by checking (✓) option 8 on

the front of this page. The executor should also indicate the date of the taxpayer’s death and supply a copy of the death

certificate.

In all cases where the taxpayer is eligible for exemption, the taxpayer must provide his/her social security number, name, address, and

phone number.

This exemption form is not valid and will not be processed without the taxpayer’s signature and date.

1

1 2

2