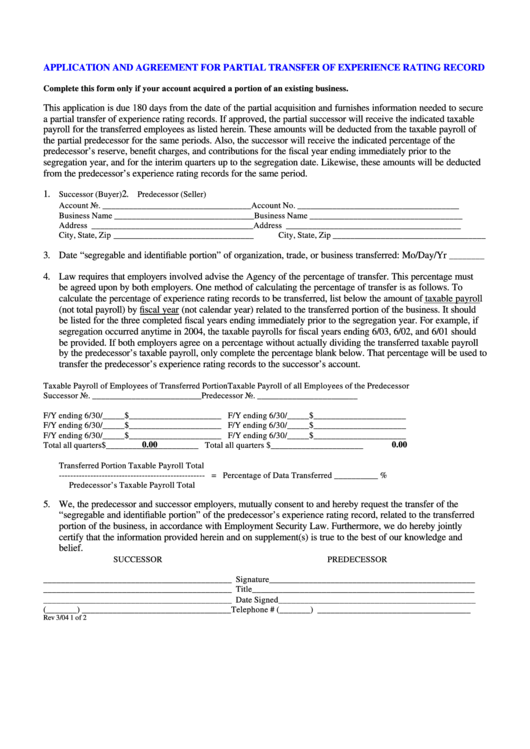

APPLICATION AND AGREEMENT FOR PARTIAL TRANSFER OF EXPERIENCE RATING RECORD

Complete this form only if your account acquired a portion of an existing business.

This application is due 180 days from the date of the partial acquisition and furnishes information needed to secure

a partial transfer of experience rating records. If approved, the partial successor will receive the indicated taxable

payroll for the transferred employees as listed herein. These amounts will be deducted from the taxable payroll of

the partial predecessor for the same periods. Also, the successor will receive the indicated percentage of the

predecessor’s reserve, benefit charges, and contributions for the fiscal year ending immediately prior to the

segregation year, and for the interim quarters up to the segregation date. Likewise, these amounts will be deducted

from the predecessor’s experience rating records for the same period.

1.

2.

Successor (Buyer)

Predecessor (Seller)

Account No. __________________________________

Account No. _____________________________________

Business Name ________________________________

Business Name ___________________________________

Address _____________________________________

Address ________________________________________

City, State, Zip ________________________________

City, State, Zip ___________________________________

3. Date “segregable and identifiable portion” of organization, trade, or business transferred: Mo/Day/Yr

________

4. Law requires that employers involved advise the Agency of the percentage of transfer. This percentage must

be agreed upon by both employers. One method of calculating the percentage of transfer is as follows. To

calculate the percentage of experience rating records to be transferred, list below the amount of taxable payroll

(not total payroll) by fiscal year (not calendar year) related to the transferred portion of the business. It should

be listed for the three completed fiscal years ending immediately prior to the segregation year. For example, if

segregation occurred anytime in 2004, the taxable payrolls for fiscal years ending 6/03, 6/02, and 6/01 should

be provided. If both employers agree on a percentage without actually dividing the transferred taxable payroll

by the predecessor’s taxable payroll, only complete the percentage blank below. That percentage will be used to

transfer the predecessor’s experience rating records to the successor’s account.

Taxable Payroll of Employees of Transferred Portion

Taxable Payroll of all Employees of the Predecessor

Successor No. _________________________

Predecessor No. _______________________

F/Y ending 6/30/_____

$_____________________

F/Y ending 6/30/_____

$_____________________

F/Y ending 6/30/_____

$_____________________

F/Y ending 6/30/_____

$_____________________

F/Y ending 6/30/_____

$_____________________

F/Y ending 6/30/_____

$_____________________

0.00

0.00

Total all quarters

$_____________________

Total all quarters

$_____________________

Transferred Portion Taxable Payroll Total

--------------------------------------------------- = Percentage of Data Transferred __________ %

Predecessor’s Taxable Payroll Total

5. We, the predecessor and successor employers, mutually consent to and hereby request the transfer of the

“segregable and identifiable portion” of the predecessor’s experience rating record, related to the transferred

portion of the business, in accordance with Employment Security Law. Furthermore, we do hereby jointly

certify that the information provided herein and on supplement(s) is true to the best of our knowledge and

belief.

SUCCESSOR

PREDECESSOR

___________________________________________ Signature_______________________________________________

___________________________________________ Title___________________________________________________

___________________________________________ Date Signed_____________________________________________

(_______) __________________________________ Telephone # (_______) ___________________________________

Rev 3/04

1 of 2

1

1 2

2