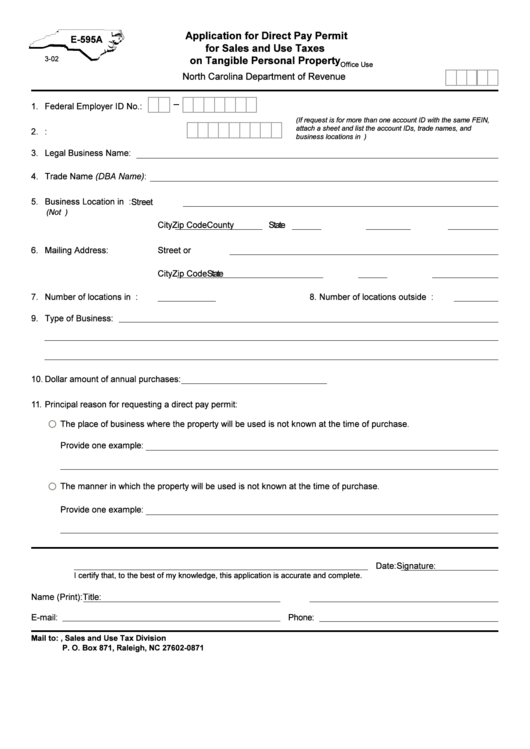

Form E-595a - Application For Direct Pay Permit For Sales And Use Taxes On Tangible Personal Property

ADVERTISEMENT

Application for Direct Pay Permit

E-595A

for Sales and Use Taxes

on Tangible Personal Property

3-02

Office Use

North Carolina Department of Revenue

1.

Federal Employer ID No.:

(If request is for more than one account ID with the same FEIN,

attach a sheet and list the account IDs, trade names, and

2.

N.C. Sales and Use Tax Account ID:

business locations in N.C.)

3.

Legal Business Name:

4.

Trade Name (DBA Name):

5.

Business Location in N.C.:

Street

(Not P.O. Box Number)

City

State

Zip Code

County

6.

Mailing Address:

Street or P.O. Box

City

State

Zip Code

7.

Number of locations in N.C.:

8. Number of locations outside N.C.:

9.

Type of Business:

10.

Dollar amount of annual purchases:

11.

Principal reason for requesting a direct pay permit:

The place of business where the property will be used is not known at the time of purchase.

Provide one example:

The manner in which the property will be used is not known at the time of purchase.

Provide one example:

Signature:

Date:

I certify that, to the best of my knowledge, this application is accurate and complete.

Name (Print):

Title:

E-mail:

Phone:

Mail to: N.C. Department of Revenue, Sales and Use Tax Division

P. O. Box 871, Raleigh, NC 27602-0871

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2