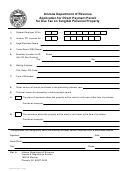

Form E-595a - Application For Direct Pay Permit For Sales And Use Taxes On Tangible Personal Property Page 2

ADVERTISEMENT

Form E-595A Reverse

General Information

·

Pursuant to G.S. 106-164.27A, a direct pay permit can be issued to a taxpayer that purchases tangible personal property

whose tax status cannot be determined at the time of purchase for one of the following reasons:

(1)

The place of business where the property will be used is not known at the time of the purchase and a different

tax consequence applies depending on where the property is used.

(2)

The manner in which the property will be used is not known at the time of the purchase and one or more of the

potential uses are taxable but others are not taxable.

·

A taxpayer’s annual purchases of tangible personal property must be at least $5 million to qualify for a direct pay permit.

·

Upon approval, the Department will issue a numbered direct pay permit. The permit holder should issue a copy of the

permit to a vendor of tangible personal property. Once received, a vendor is relieved of the liability from collecting and

remitting sales or use tax on its sales of tangible personal property to the permit holder. The permit holder is liable for

accruing and remitting the applicable use tax directly to the Department.

·

A permit holder is required to issue its permit to vendors for all purchases of tangible personal property except those

purchases subject to the taxes listed below. The permit holder must pay the taxes listed below directly to vendors.

(1)

State and local sales taxes levied on sales of prepared food and beverages.

(2)

Prepared food and beverage taxes levied by various local governments in the State.

(3)

State and local sales taxes levied on hotel, motel, or other accommodation rentals.

(4)

Occupancy taxes levied and administered by various local governments in the State.

(5)

Highway use taxes paid on the purchase, lease, or rental of motor vehicles.

(6)

State sales taxes levied on electricity or local, private or toll telecommunications services.

(7)

Scrap tire disposal tax levied on new tires.

(8)

White goods disposal tax levied on new white goods.

(9)

Dry-cleaning solvent tax levied on dry-cleaning solvent purchased by a dry-cleaning facility.

(10) Excise tax on piped natural gas.

·

The Department may revoke a direct pay permit if the holder of the permit does not file a sales and use tax return timely,

does not pay sales or use tax on time, or otherwise fails to comply with the Sales and Use Tax Laws.

·

If you have questions, you may contact the Sales and Use Tax Division, NC Department of Revenue, P.O. Box 871,

Raleigh, North Carolina 27602-0871. You may also telephone the Division at (919) 733-2151.

Line by Line Instructions

Line 1 -

Enter your firm’s Federal Employer Identification Number (FEIN). Direct Pay Permits are issued by FEIN. A

separate application must be completed for each FEIN.

Line 2 -

Enter your firm’s North Carolina Sales and Use Tax Account ID Number. If you are requesting a Direct Pay Permit

for more than one account ID with the same FEIN, attach a sheet and list the account IDs, trade names, and

business locations in North Carolina.

Line 3 -

Enter the Legal Business Name for which a Direct Pay Permit is requested.

Line 4 -

Enter the Trade Name for which a Direct Pay Permit is requested.

Line 5 -

Enter the business address of your firm in North Carolina. For multiple locations see the instruction for Line 2.

Line 6 -

Enter the mailing address to which all correspondence concerning the Direct Pay Permit should be mailed.

Line 7 -

Enter the number of locations in North Carolina.

Line 8 -

Enter the number of locations outside of North Carolina.

Line 9 -

Describe the type of business your firm operates.

Line 10 - Enter an estimate of all annual purchases of tangible personal property made by your firm.

Line 11 - Select the principal reason for requesting a Direct Pay Permit and give a specific example that supports your

reason.

Sign and date the application. Print your name along with your title, phone number, and email address where you can be

reached if we have questions about your application. Mail your application to NC Department of Revenue, Sales and

Use Tax Division, P.O. Box 871, Raleigh, NC 27602-0871.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2