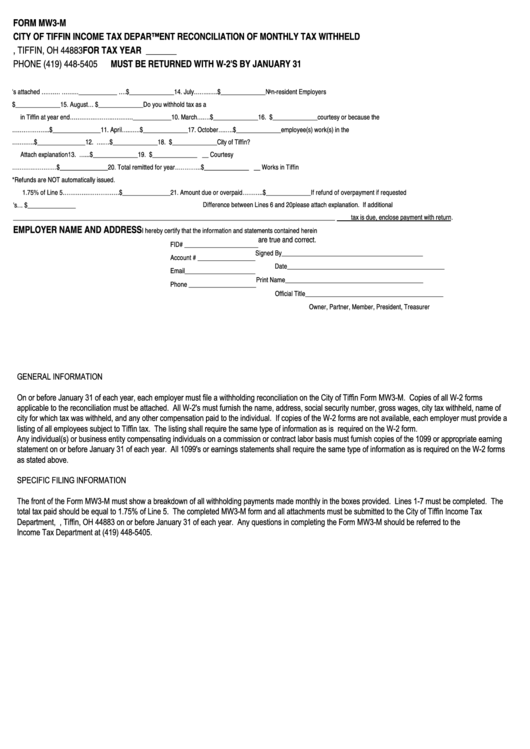

FORM MW3-M

CITY OF TIFFIN INCOME TAX DEPARTMENT

RECONCILIATION OF MONTHLY TAX WITHHELD

P.O. BOX 518, TIFFIN, OH 44883

FOR TAX YEAR _______

PHONE (419) 448-5405

MUST BE RETURNED WITH W-2'S BY JANUARY 31

1. Number of W-2's attached ….…….....………____________

8. January….$______________

14. July……...….$______________

Non-resident Employers

2. Number of employees working

9. February...$______________

15. August…......$______________

Do you withhold tax as a

in Tiffin at year end………….……….………..____________

10. March….…$______________

16. September....$______________

courtesy or because the

3. Total payroll for the year………………..$_______________

11. April…..…..$______________

17. October….….$______________

employee(s) work(s) in the

4. Less payroll not subject to tax…….…..$_______________

12. May...….…$______________

18. November....$______________

City of Tiffin?

Attach explanation

13. June...…...$______________

19. December....$______________

__ Courtesy

5. Payroll subject to tax…….…..…………$_______________

20. Total remitted for year…………..$______________

__ Works in Tiffin

6. Withholding tax liability at

Add Lines 8 through 19

*Refunds are NOT automatically issued.

1.75% of Line 5…………………………$_______________

21. Amount due or overpaid………..$______________

If refund of overpayment if requested

7. Total Tiffin tax withheld per W-2's…....$_______________

Difference between Lines 6 and 20

please attach explanation. If additional

_____________________________________________________________________________________________________

tax is due, enclose payment with return.

EMPLOYER NAME AND ADDRESS

I hereby certify that the information and statements contained herein

are true and correct.

FID# _______________________

Signed By____________________________________________

Account # __________________

Date_________________________________________________

Email______________________

Print Name___________________________________________

Phone _____________________

Official Title___________________________________________

Owner, Partner, Member, President, Treasurer

GENERAL INFORMATION

On or before January 31 of each year, each employer must file a withholding reconciliation on the City of Tiffin Form MW3-M. Copies of all W-2 forms

applicable to the reconciliation must be attached. All W-2's must furnish the name, address, social security number, gross wages, city tax withheld, name of

city for which tax was withheld, and any other compensation paid to the individual. If copies of the W-2 forms are not available, each employer must provide a

listing of all employees subject to Tiffin tax. The listing shall require the same type of information as is required on the W-2 form.

Any individual(s) or business entity compensating individuals on a commission or contract labor basis must furnish copies of the 1099 or appropriate earning

statement on or before January 31 of each year. All 1099's or earnings statements shall require the same type of information as is required on the W-2 forms

as stated above.

SPECIFIC FILING INFORMATION

The front of the Form MW3-M must show a breakdown of all withholding payments made monthly in the boxes provided. Lines 1-7 must be completed. The

total tax paid should be equal to 1.75% of Line 5. The completed MW3-M form and all attachments must be submitted to the City of Tiffin Income Tax

Department, P.O. Box 518, Tiffin, OH 44883 on or before January 31 of each year. Any questions in completing the Form MW3-M should be referred to the

Income Tax Department at (419) 448-5405.

1

1