Form W3q/m - Reconciliation Of Monthly And Quarterly Returns Of Tax Withheld

ADVERTISEMENT

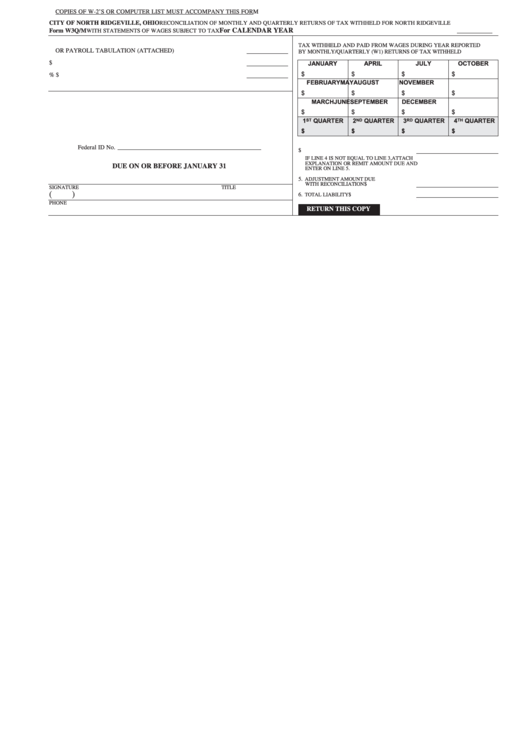

COPIES OF W-2’S OR COMPUTER LIST MUST ACCOMPANY THIS FORM

CITY OF NORTH RIDGEVILLE, OHIO

RECONCILIATION OF MONTHLY AND QUARTERLY RETURNS OF TAX WITHHELD FOR NORTH RIDGEVILLE

For CALENDAR YEAR

Form W3Q/M

WITH STATEMENTS OF WAGES SUBJECT TO TAX

1. NUMBER OF EMPLOYEES REPRESENTED BY W-2 STATEMENTS

TAX WITHHELD AND PAID FROM WAGES DURING YEAR REPORTED

OR PAYROLL TABULATION (ATTACHED) ............................................

BY MONTHLY/QUARTERLY (W1) RETURNS OF TAX WITHHELD

2. TOTAL PAYROLL TAXABLE TO NORTH RIDGEVILLE ......................

$

JANUARY

APRIL

JULY

OCTOBER

$

$

$

$

3. TAX RATE OF 1% ......................................................................................

$

FEBRUARY

MAY

AUGUST

NOVEMBER

$

$

$

$

MARCH

JUNE

SEPTEMBER

DECEMBER

$

$

$

$

1

ST

QUARTER

2

ND

QUARTER

3

RD

QUARTER

4

TH

QUARTER

$

$

$

$

Federal ID No.

4. TOTAL PAID DURING YEAR

$

IF LINE 4 IS NOT EQUAL TO LINE 3, ATTACH

EXPLANATION OR REMIT AMOUNT DUE AND

DUE ON OR BEFORE JANUARY 31

ENTER ON LINE 5.

5.

ADJUSTMENT AMOUNT DUE

WITH RECONCILIATION

$

SIGNATURE

TITLE

(

)

6.

TOTAL LIABILITY

$

PHONE NO.

DATE

RETURN THIS COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1