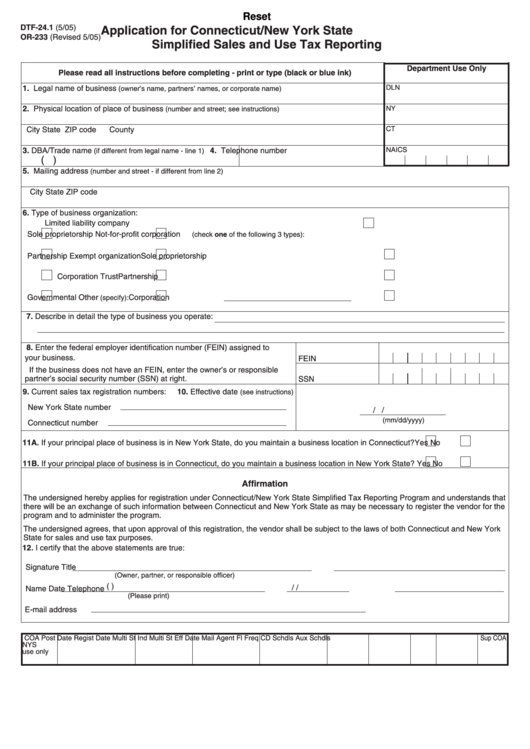

Reset

DTF-24.1 (5/05)

Application for Connecticut/New York State

OR-233 (Revised 5/05)

Simplified Sales and Use Tax Reporting

Department Use Only

Please read all instructions before completing - print or type (black or blue ink)

1. Legal name of business

DLN

(owner’s name, partners’ names, or corporate name)

2. Physical location of place of business

NY

(number and street; see instructions)

CT

City

State

ZIP code

County

3. DBA/Trade name

4. Telephone number

NAICS

(if different from legal name - line 1)

(

)

5. Mailing address

(number and street - if different from line 2)

City

State

ZIP code

6. Type of business organization:

Limited liability company

Sole proprietorship

Not-for-profit corporation

(check one of the following 3 types):

Partnership

Exempt organization

Sole proprietorship

Corporation

Trust

Partnership

Governmental

Other

Corporation

(specify):

7. Describe in detail the type of business you operate:

8. Enter the federal employer identification number (FEIN) assigned to

your business.

FEIN

..............................

If the business does not have an FEIN, enter the owner’s or responsible

partner’s social security number (SSN) at right.

SSN ............................

9. Current sales tax registration numbers:

10. Effective date

(see instructions)

New York State number

/

/

(mm/dd/yyyy)

Connecticut number

11A. If your principal place of business is in New York State, do you maintain a business location in Connecticut?

Yes

No

11B. If your principal place of business is in Connecticut, do you maintain a business location in New York State?

Yes

No

Affirmation

The undersigned hereby applies for registration under Connecticut/New York State Simplified Tax Reporting Program and understands that

there will be an exchange of such information between Connecticut and New York State as may be necessary to register the vendor for the

program and to administer the program.

The undersigned agrees, that upon approval of this registration, the vendor shall be subject to the laws of both Connecticut and New York

State for sales and use tax purposes.

12. I certify that the above statements are true:

Signature

Title

(Owner, partner, or responsible officer)

Telephone (

)

/

/

Name

Date

(Please print)

E-mail address

COA Post Date

Regist Date

Multi St Ind

Multi St Eff Date

Mail Agent

Fl Freq CD

Schdls Aux Schdls Sup COA

NYS

use only

1

1