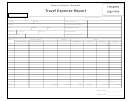

Travel Expenses Voucher Template Page 2

ADVERTISEMENT

GENERAL INSTRUCTIONS

1.

Each county employee claiming travel expenses reimbursement shall submit only one voucher for each calendar month.

2.

Information on voucher must be typewritten or legibly printed

3.

Receipts required for all expenditures for commercial transportation except taxi fares of $20.00 or less.

4.

The employee must have been in travel status one hour before the start of the quarter being claimed, and travel status

must extend at least one hour into the quarter being claimed.

5.

If a meal is included in a registration fee, the applicable quarter allowance cannot be claimed.

IN STATE TRAVEL

Personal vehicle mileage shall be reimbursed at the sum of the IRS rate or the state rate whichever is greater for each mile

actually and necessarily traveled in the performance of official duty when such travel is by motor vehicle. The State rate

.56

January 1, 2014

and IRS rate are currently at

cents effective

.

Maximum quarter-day reimbursement for meals and lodging as follows, according to

NDCC 44-08-04(2)effective October 1, 2013:

1st quarter 6:00 a.m. to 12:00 noon

$7.00

2nd quarter 12:00 noon to 6:00 p.m.

$10.50

3rd quarter 6:00 to 12:00 midnight

$17.50

4th quarter 12:00 midnight to 6:00 a.m., actual lodging expense not exceeding

$74.70

Effective October 1, 2013 Reimbursment for lodging has increased for the areas listed below.

City

County

Lodging amount

Dickinson/Beulah

Stark, Mercer, Billings

$108.00

Minot

Ward

$112.50

Williston

Williams

$94.50

OUT OF STATE TRAVEL

Maximum quarter-day reimbursement for meals and lodging

as follows, according to NDCC 44-08-04(3):

1st quarter 6:00 a.m. to 12:00 noon

20%

2nd quarter 12:00 noon to 6:00 p.m.

30%

3rd quarter 6:00 to 12:00 midnight

50%

4th quarter 12:00 midnight to 6:00 a.m., actual lodging expense. Receipts required.

Reimbursement is based on the Federal Rate. The allowance for out-of-state meals, within the continental United States, is

equal to the per diem meals rate in the city for which a claim is made on that day as established by rule for federal employees

by the United States general services administration and must be allowed twenty percent to the first quarter, thirty percent

to the second quarter, and fifty percent to the third quarter. The website used for out-of-state travel is

Authorization for out-of-state travel must be obtained from the Board of Commissioners prior to the actual date(s) of travel.

Emergency approval may be granted by the Chair of the Board of Commissioners and one other Commissioner. Prior

authorization for out-of-state travel is not required if the employee will accept the instate reimbursement rates and the

distance traveled is not more than 150 miles outside the borders of North Dakota.

44-08-05 Civil recovery of public funds-Any person who receives public funds for the discharge of a public duty in excess of

the amounts allowed by law shall, thirty days after a demand for a return of such excess amount has been made by the

attorney general, be subject to a civil suit to be brought by the attorney general for the recovery of the amount received in

excess of that lawfully allowed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2