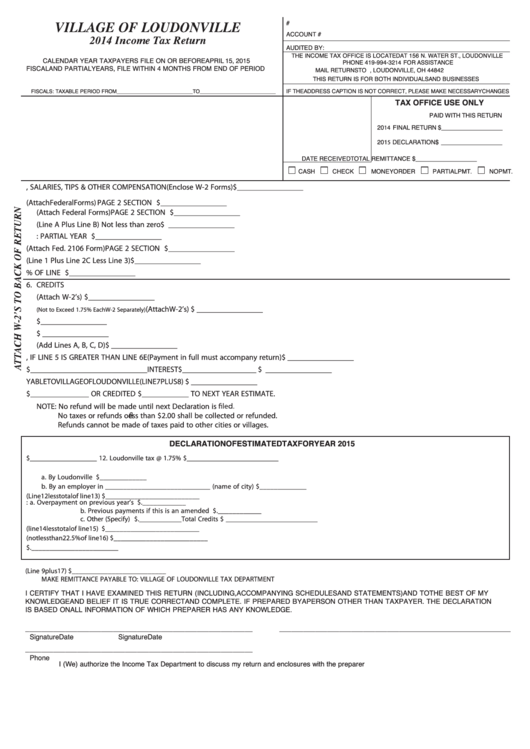

Income Tax Return Form - Village Of Loudonville - 2014

ADVERTISEMENT

S.S.N./F.I.D.#

ACCOUNT #

14

AUDITED BY:

THE INCOME TAX OFFICE IS LOCATED AT 156 N. WATER ST., LOUDONVILLE

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15, 2015

PHONE 419-994-3214 FOR ASSISTANCE

FISCAL AND PARTIAL YEARS, FILE WITHIN 4 MONTHS FROM END OF PERIOD

MAIL RETURNS TO P.O. BOX 150, LOUDONVILLE, OH 44842

THIS RETURN IS FOR BOTH INDIVIDUALS AND BUSINESSES

IF THE ADDRESS CAPTION IS NOT CORRECT, PLEASE MAKE NECESSARY CHANGES

FISCALS: TAXABLE PERIOD FROM__________________________ TO__________________________

TAX OFFICE USE ONLY

PAID WITH THIS RETURN

2014 FINAL RETURN $ __________________

2015 DECLARATION $ __________________

DATE RECEIVED

TOTAL REMITTANCE $ __________________

CASH

CHECK

MONEY ORDER

PARTIAL PMT.

NO PMT.

1. WAGES, SALARIES, TIPS & OTHER COMPENSATION (Enclose W-2 Forms) .................................................................................................... $ _________________

2. A.

BUSINESS PROFIT (Attach Federal Forms) PAGE 2 SECTION A....................................................................$ _________________

B.

RENTAL INCOME (Attach Federal Forms) PAGE 2 SECTION B .......................................................................$ _________________

C.

TOTAL OTHER TAXABLE INCOME(Line A Plus Line B) Not less than zero........................................................................................... $ _________________

D. ADJUSTMENTS: PARTIAL YEAR LIABILITY......................................................................................................................................................... $ _________________

3. DEDUCT EMPLOYEE BUSINESS EXPENSE (Attach Fed. 2106 Form) PAGE 2 SECTION C ........................................................................ $ _________________

4. TAXABLE INCOME (Line 1 Plus Line 2C Less Line 3) .............................................................................................................................................. $ _________________

5. VILLAGE INCOME TAX DUE 1.75% OF LINE 4............................................................................................................................................................ $ _________________

6. CREDITS

A.

LOUDONVILLE INCOME TAX WITHHELD (Attach W-2’s) .............................................................................. $ _________________

(Attach W-2’s).... $ _________________

B.

INCOME TAX PAID OTHER MUNICIPALITIES

(Not to Exceed 1.75% Each W-2 Separately)

C.

OVERPAYMENT FROM PRIOR YEAR...................................................................................................................... $ _________________

D. ESTIMATED TAX PAYMENTS.................................................................................................................................... $ _________________

E.

TOTAL CREDITS (Add Lines A, B, C, D) ............................................................................................................................................................... $ _________________

7. BALANCE TAX DUE, IF LINE 5 IS GREATER THAN LINE 6E (Payment in full must accompany return) .................................................... $ _________________

8. PENALTY $______________________________ INTEREST $___________________ PAGE 2 SECTION D ........................................ $ _________________

9. AMOUNT DUE PAYABLE TO VILLAGE OF LOUDONVILLE (LINE 7 PLUS 8) ...................................................................................................... $ _________________

10.OVERPAYMENT TO BE REFUNDED $_______________ OR CREDITED $____________ TO NEXT YEAR ESTIMATE.

NOTE: No refund will be made until next Declaration is

No taxes or refunds o ess than $2.00 shall be collected or refunded.

Refunds cannot be made of taxes paid to other cities or villages.

DECLARATION OF ESTIMATED TAX FOR YEAR 2015

11. Total income subject to Loudonville tax $___________________ 12. Loudonville tax @ 1.75% ........................................................$ __________________________

13. LESS TAX TO BE WITHHELD

a. By Loudonville Employer .................................................................................................................................................$ _____________

b. By an employer in _____________________________ (name of city) ............................................................$ _____________

14. Balance estimated Loudonville tax (Line 12 less total of line 13) .................................................................................................................$ __________________________

15. Less Credits: a. Overpayment on previous year’s return...................................................................... $ . ____________

b. Previous payments if this is an amended declaration........................................... $ . ____________

c. Other (Specify) .................................................................................................................... $ . ____________ Total Credits $ __________________________

16. Next tax due (line 14 less total of line 15) ..............................................................................................................................................................$ __________________________

17. Amount paid with this return (not less than 22.5% of line 16)........................................................................................................................$ __________________________

18. Balance of Tax.................................................................................................................................................... $.________________________

19.Total Amount Due (Line 9 plus 17) ............................................................................................................................................................................... $ __________________________

MAKE REMITTANCE PAYABLE TO: VILLAGE OF LOUDONVILLE TAX DEPARTMENT

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING, ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IT IS TRUE CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER. THE DECLARATION

IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

_________________________________________________________

__________________________________________________________

Signature

Date

Signature

Date

_________________________________________________________

Phone

I (We) authorize the Income Tax Department to discuss my return and enclosures with the preparer above. Initial here____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4