Income Tax Return Form - Village Of Loudonville

ADVERTISEMENT

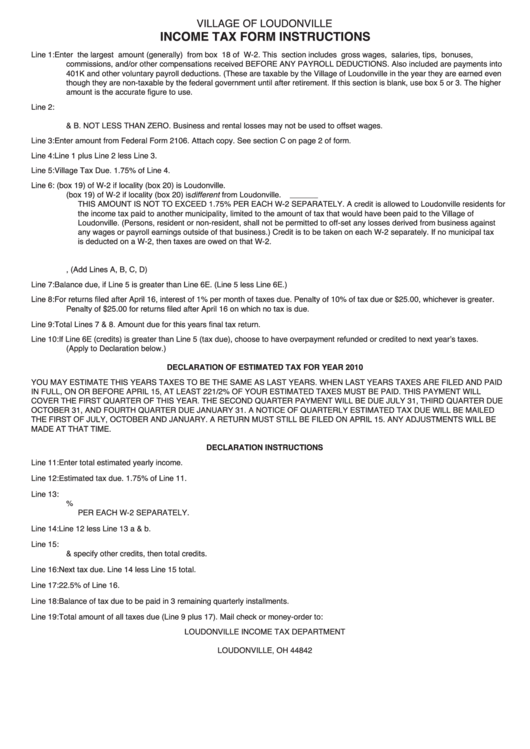

VILLAGE OF LOUDONVILLE

INCOME TAX FORM INSTRUCTIONS

Line 1:

Enter the largest amount (generally) from box 18 of W-2. This section includes gross wages, salaries, tips, bonuses,

commissions, and/or other compensations received BEFORE ANY PAYROLL DEDUCTIONS. Also included are payments into

401K and other voluntary payroll deductions. (These are taxable by the Village of Loudonville in the year they are earned even

though they are non-taxable by the federal government until after retirement. If this section is blank, use box 5 or 3. The higher

amount is the accurate figure to use.

Line 2:

A. Enter amount from appropriate Federal Form. Attach copy. SEE SECTION A ON PAGE 2 OF FORM.

B. Enter amount from Federal Schedule E and attach copy.

C. Total A & B. NOT LESS THAN ZERO. Business and rental losses may not be used to offset wages.

Line 3:

Enter amount from Federal Form 2106. Attach copy. See section C on page 2 of form.

Line 4:

Line 1 plus Line 2 less Line 3.

Line 5:

Village Tax Due. 1.75% of Line 4.

Line 6:

A. From Local Income Tax (box 19) of W-2 if locality (box 20) is Loudonville.

B. From Local Income Tax (box 19) of W-2 if locality (box 20) is different from Loudonville.

THIS AMOUNT IS NOT TO EXCEED 1.75% PER EACH W-2 SEPARATELY. A credit is allowed to Loudonville residents for

the income tax paid to another municipality, limited to the amount of tax that would have been paid to the Village of

Loudonville. (Persons, resident or non-resident, shall not be permitted to off-set any losses derived from business against

any wages or payroll earnings outside of that business.) Credit is to be taken on each W-2 separately. If no municipal tax

is deducted on a W-2, then taxes are owed on that W-2.

C. Enter any overpayment from previous year. Leave blank if credit was already taken on Declaration Payments.

D. Enter Declaration of Estimated Tax payments

E. Total Credits, (Add Lines A, B, C, D)

Line 7:

Balance due, if Line 5 is greater than Line 6E. (Line 5 less Line 6E.)

Line 8:

For returns filed after April 16, interest of 1% per month of taxes due. Penalty of 10% of tax due or $25.00, whichever is greater.

Penalty of $25.00 for returns filed after April 16 on which no tax is due.

Line 9:

Total Lines 7 & 8. Amount due for this years final tax return.

Line 10: If Line 6E (credits) is greater than Line 5 (tax due), choose to have overpayment refunded or credited to next yearʼs taxes.

(Apply to Declaration below.)

DECLARATION OF ESTIMATED TAX FOR YEAR 2010

YOU MAY ESTIMATE THIS YEARS TAXES TO BE THE SAME AS LAST YEARS. WHEN LAST YEARS TAXES ARE FILED AND PAID

IN FULL, ON OR BEFORE APRIL 15, AT LEAST 22 1/2% OF YOUR ESTIMATED TAXES MUST BE PAID. THIS PAYMENT WILL

COVER THE FIRST QUARTER OF THIS YEAR. THE SECOND QUARTER PAYMENT WILL BE DUE JULY 31, THIRD QUARTER DUE

OCTOBER 31, AND FOURTH QUARTER DUE JANUARY 31. A NOTICE OF QUARTERLY ESTIMATED TAX DUE WILL BE MAILED

THE FIRST OF JULY, OCTOBER AND JANUARY. A RETURN MUST STILL BE FILED ON APRIL 15. ANY ADJUSTMENTS WILL BE

MADE AT THAT TIME.

DECLARATION INSTRUCTIONS

Line 11: Enter total estimated yearly income.

Line 12: Estimated tax due. 1.75% of Line 11.

Line 13: a. Enter amount of tax to be withheld by employer for Loudonville.

b. Enter amount of tax to be withheld by employer for other city. NOT TO EXCEED 1.75%

PER EACH W-2 SEPARATELY.

Line 14: Line 12 less Line 13 a & b.

Line 15: a. Enter any overpayment from Line 10 of prior return.

b. Enter & specify other credits, then total credits.

Line 16: Next tax due. Line 14 less Line 15 total.

Line 17: 22.5% of Line 16.

Line 18: Balance of tax due to be paid in 3 remaining quarterly installments.

Line 19: Total amount of all taxes due (Line 9 plus 17). Mail check or money-order to:

LOUDONVILLE INCOME TAX DEPARTMENT

P.O. BOX 115

LOUDONVILLE, OH 44842

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2