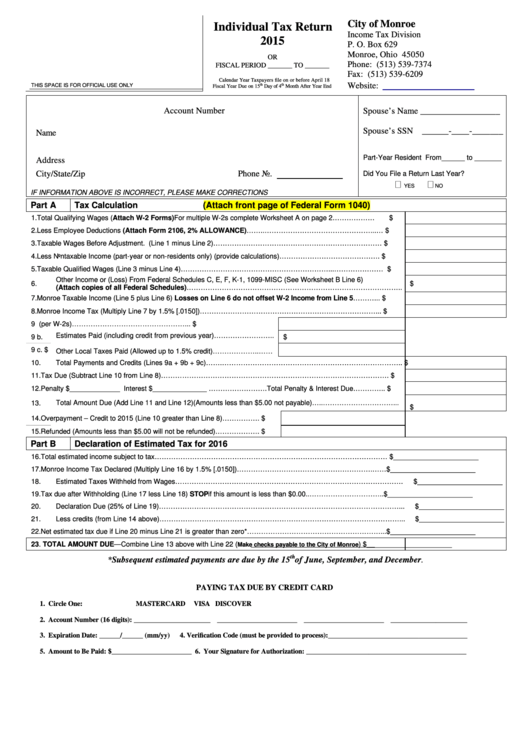

Individual Tax Return Form - City Of Monroe - 2015

ADVERTISEMENT

City of Monroe

Individual Tax Return

Income Tax Division

2015

P. O. Box 629

Monroe, Ohio 45050

OR

Phone: (513) 539-7374

FISCAL PERIOD _______ TO _______

Fax: (513) 539-6209

Calendar Year Taxpayers file on or before April 18

Website:

THIS SPACE IS FOR OFFICIAL USE ONLY

th

th

Fiscal Year Due on 15

Day of 4

Month After Year End

Account Number

Spouse’s Name __________________

Spouse’s SSN ______-____-_______

Name

Part-Year Resident From______ to _______

Address

Phone No.

City/State/Zip

Did You File a Return Last Year?

YES

NO

IF INFORMATION ABOVE IS INCORRECT, PLEASE MAKE CORRECTIONS

Part A

Tax Calculation

(Attach front page of Federal Form 1040)

1.

Total Qualifying Wages (Attach W-2 Forms) For multiple W-2s complete Worksheet A on page 2………………

$

Less Employee Deductions (Attach Form 2106, 2% ALLOWANCE)……..………………………………………...…

2.

$

3.

Taxable Wages Before Adjustment. (Line 1 minus Line 2)………………………………………………………………

$

4.

Less Nontaxable Income (part-year or non-residents only) (provide calculations)…………………………………….

$

5.

Taxable Qualified Wages (Line 3 minus Line 4)………………………………………………………...…………………

$

Other Income or (Loss) From Federal Schedules C, E, F, K-1, 1099-MISC (See Worksheet B Line 6)

6.

$

(Attach copies of all Federal Schedules)………………………………………………………………………………..

7.

Monroe Taxable Income (Line 5 plus Line 6) Losses on Line 6 do not offset W-2 Income from Line 5………...

$

8.

Monroe Income Tax (Multiply Line 7 by 1.5% [.0150])…………………………………………………………………...

$

9 a.

Monroe Tax Withheld (per W-2s)…………………………………………...

$

Estimates Paid (including credit from previous year)……………………..

9 b.

$

9 c.

$

Other Local Taxes Paid (Allowed up to 1.5% credit)………………..……

10.

Total Payments and Credits (Lines 9a + 9b + 9c)…….…………………………………………………………………..

$

11.

Tax Due (Subtract Line 10 from Line 8)…………………………………………………………………………………….

$

12.

Penalty $_____________ Interest $______________ …………………….Total Penalty & Interest Due…………..

$

13.

Total Amount Due (Add Line 11 and Line 12)(Amounts less than $5.00 not payable)…..…………………………...

$

14.

Overpayment – Credit to 2015 (Line 10 greater than Line 8)…………….

$

15.

Refunded (Amounts less than $5.00 will not be refunded)……………….

$

Part B

Declaration of Estimated Tax for 2016

16.

Total estimated income subject to tax………………………………………………………………………………………

$______________________

17.

Monroe Income Tax Declared (Multiply Line 16 by 1.5% [.0150])………………………………………………….……

$______________________

18.

Estimated Taxes Withheld from Wages…………………………………………………………………………………….

$______________________

Tax due after Withholding (Line 17 less Line 18) STOP if this amount is less than $0.00..…………………………..

19.

$______________________

20.

Declaration Due (25% of Line 19)…………………………………………………………………………………………...

$______________________

21.

Less credits (from Line 14 above)…………………………………………………………………………………………...

$______________________

22.

Net estimated tax due if Line 20 minus Line 21 is greater than zero*…………………………………………………...

$______________________

23.

TOTAL AMOUNT DUE—Combine Line 13 above with Line 22 (

)

$______________________

Make checks payable to the City of Monroe

th

*Subsequent estimated payments are due by the 15

of June, September, and December.

PAYING TAX DUE BY CREDIT CARD

1. Circle One:

MASTERCARD

VISA

DISCOVER

2. Account Number (16 digits): ______________________ _______________________ _______________________ ______________________

3. Expiration Date: ______/______ (mm/yy)

4. Verification Code (must be provided to process):________________________________________

5. Amount to Be Paid: $_______________________ 6. Your Signature for Authorization: ______________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2