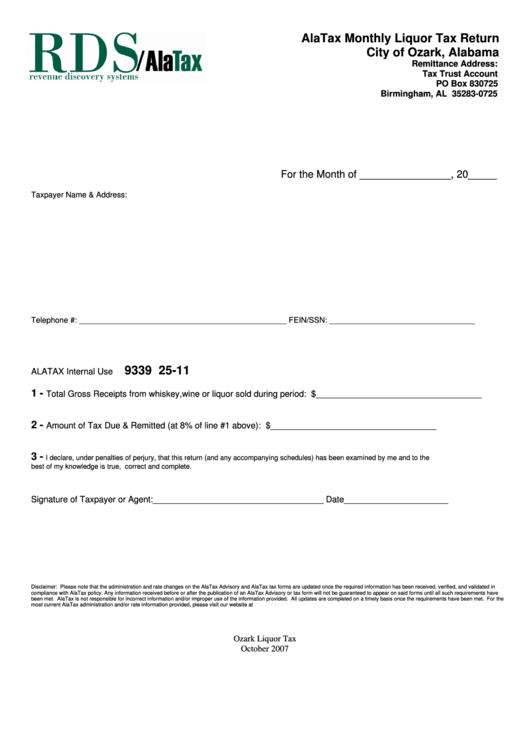

Alatax Monthly Liquor Tax Return - City Of Ozark

ADVERTISEMENT

AlaTax Monthly Liquor Tax Return

City of Ozark, Alabama

Remittance Address:

Tax Trust Account

PO Box 830725

Birmingham, AL 35283-0725

For the Month of ________________, 20_____

Taxpayer Name & Address:

Telephone #: _______________________________________________

FEIN/SSN: _________________________________

9339

25-11

ALATAX Internal Use

1 -

Total Gross Receipts from whiskey,wine or liquor sold during period: $___________________________________

2 -

Amount of Tax Due & Remitted (at 8% of line #1 above):

$___________________________________

3 -

I declare, under penalties of perjury, that this return (and any accompanying schedules) has been examined by me and to the

best of my knowledge is true, correct and complete.

Signature of Taxpayer or Agent:____________________________________ Date______________________

Disclaimer: Please note that the administration and rate changes on the AlaTax Advisory and AlaTax tax forms are updated once the required information has been received, verified, and validated in

compliance with AlaTax policy. Any information received before or after the publication of an AlaTax Advisory or tax form will not be guaranteed to appear on said forms until all such requirements have

been met. AlaTax is not responsible for incorrect information and/or improper use of the information provided. All updates are completed on a timely basis once the requirements have been met. For the

most current AlaTax administration and/or rate information provided, please visit our website at

Ozark Liquor Tax

October 2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1