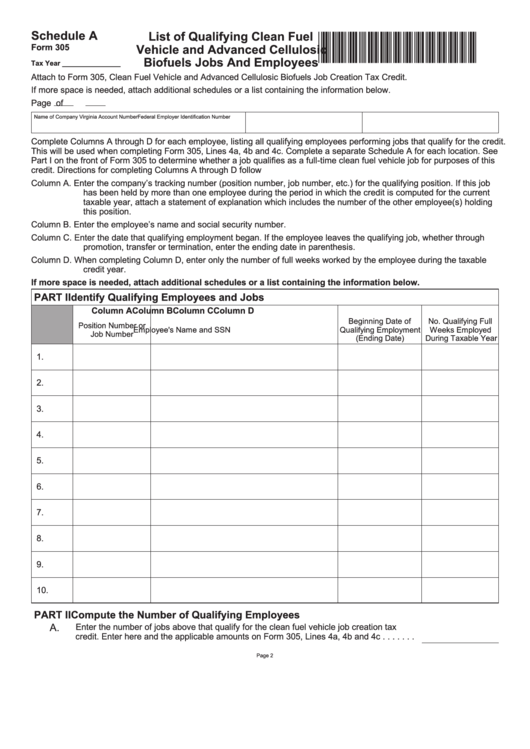

Schedule A

List of Qualifying Clean Fuel

*VA305A112888*

Vehicle and Advanced Cellulosic

Form 305

Biofuels Jobs And Employees

Tax Year _______________

Attach to Form 305, Clean Fuel Vehicle and Advanced Cellulosic Biofuels Job Creation Tax Credit.

If more space is needed, attach additional schedules or a list containing the information below.

Page

of

Name of Company

Virginia Account Number

Federal Employer Identification Number

Complete Columns A through D for each employee, listing all qualifying employees performing jobs that qualify for the credit.

This will be used when completing Form 305, Lines 4a, 4b and 4c. Complete a separate Schedule A for each location. See

Part I on the front of Form 305 to determine whether a job qualifies as a full-time clean fuel vehicle job for purposes of this

credit. Directions for completing Columns A through D follow

Column A.

Enter the company’s tracking number (position number, job number, etc.) for the qualifying position. If this job

has been held by more than one employee during the period in which the credit is computed for the current

taxable year, attach a statement of explanation which includes the number of the other employee(s) holding

this position.

Column B.

Enter the employee’s name and social security number.

Column C.

Enter the date that qualifying employment began. If the employee leaves the qualifying job, whether through

promotion, transfer or termination, enter the ending date in parenthesis.

Column D.

When completing Column D, enter only the number of full weeks worked by the employee during the taxable

credit year.

If more space is needed, attach additional schedules or a list containing the information below.

PART I Identify Qualifying Employees and Jobs

Column A

Column B

Column C

Column D

Beginning Date of

No. Qualifying Full

Position Number or

Employee's Name and SSN

Qualifying Employment

Weeks Employed

Job Number

(Ending Date)

During Taxable Year

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

PART II Compute the Number of Qualifying Employees

A.

Enter the number of jobs above that qualify for the clean fuel vehicle job creation tax

credit. Enter here and the applicable amounts on Form 305, Lines 4a, 4b and 4c . . . . . . .

Page 2

1

1