PRINT FORM

CLEAR FIELDS

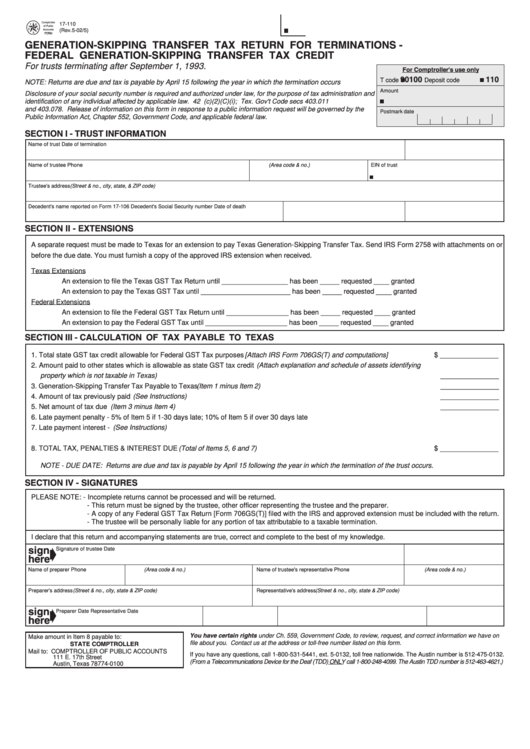

17-110

(Rev.5-02/5)

GENERATION-SKIPPING TRANSFER TAX RETURN FOR TERMINATIONS

FEDERAL GENERATION-SKIPPING TRANSFER TAX CREDIT

For trusts terminating after September 1, 1993.

For Comptroller's use only

90100

110

T code

Deposit code

NOTE: Returns are due and tax is payable by April 15 following the year in which the termination occurs

Amount

Disclosure of your social security number is required and authorized under law, for the purpose of tax administration and

identification of any individual affected by applicable law. 42 U.S.C. sec. 405(c)(2)(C)(i); Tex. Gov't Code secs 403.011

and 403.078. Release of information on this form in response to a public information request will be governed by the

Postmark date

Public Information Act, Chapter 552, Government Code, and applicable federal law.

SECTION I - TRUST INFORMATION

Name of trust

Date of termination

Phone (Area code & no.)

Name of trustee

EIN of trust

Trustee's address (Street & no., city, state, & ZIP code)

Decedent's name reported on Form 17-106

Decedent's Social Security number

Date of death

SECTION II - EXTENSIONS

A separate request must be made to Texas for an extension to pay Texas Generation-Skipping Transfer Tax. Send IRS Form 2758 with attachments on or

before the due date. You must furnish a copy of the approved IRS extension when received.

Texas Extensions

An extension to file the Texas GST Tax Return until _________________ has been _____ requested ____ granted

An extension to pay the Texas GST Tax until _______________________ has been _____ requested ____ granted

Federal Extensions

An extension to file the Federal GST Tax Return until ________________ has been _____ requested ____ granted

An extension to pay the Federal GST Tax until _____________________ has been _____ requested ____ granted

SECTION III - CALCULATION OF TAX PAYABLE TO TEXAS

1. Total state GST tax credit allowable for Federal GST Tax purposes [Attach IRS Form 706GS(T) and computations] ..................... $ _______________

2. Amount paid to other states which is allowable as state GST tax credit (Attach explanation and schedule of assets identifying

property which is not taxable in Texas) .............................................................................................................................................

_______________

3. Generation-Skipping Transfer Tax Payable to Texas (Item 1 minus Item 2) .......................................................................................

_______________

4. Amount of tax previously paid (See Instructions) ..............................................................................................................................

_______________

5. Net amount of tax due (Item 3 minus Item 4) ....................................................................................................................................

_______________

6. Late payment penalty - 5% of Item 5 if 1-30 days late; 10% of Item 5 if over 30 days late ...............................................................

_______________

7. Late payment interest - (See Instructions) ........................................................................................................................................

_______________

8. TOTAL TAX, PENALTIES & INTEREST DUE (Total of Items 5, 6 and 7) .......................................................................................... $ _______________

NOTE - DUE DATE: Returns are due and tax is payable by April 15 following the year in which the termination of the trust occurs.

SECTION IV - SIGNATURES

PLEASE NOTE: - Incomplete returns cannot be processed and will be returned.

- This return must be signed by the trustee, other officer representing the trustee and the preparer.

- A copy of any Federal GST Tax Return [Form 706GS(T)] filed with the IRS and approved extension must be included with the return.

- The trustee will be personally liable for any portion of tax attributable to a taxable termination.

I declare that this return and accompanying statements are true, correct and complete to the best of my knowledge.

➧

sign

Signature of trustee

Date

here

Name of preparer

Phone (Area code & no.)

Name of trustee's representative

Phone (Area code & no.)

Preparer's address (Street & no., city, state & ZIP code)

Representative's address (Street & no., city, state & ZIP code)

➧

sign

Preparer

Date

Representative

Date

here

You have certain rights under Ch. 559, Government Code, to review, request, and correct information we have on

Make amount in Item 8 payable to:

file about you. Contact us at the address or toll-free number listed on this form.

STATE COMPTROLLER

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

If you have any questions, call 1-800-531-5441, ext. 5-0132, toll free nationwide. The Austin number is 512-475-0132.

111 E. 17th Street

(From a Telecommunications Device for the Deaf (TDD) ONLY call 1-800-248-4099. The Austin TDD number is 512-463-4621.)

Austin, Texas 78774-0100

1

1