Form Et-501 - Generation-Skipping Transfer Tax Return For Terminations - 2012

ADVERTISEMENT

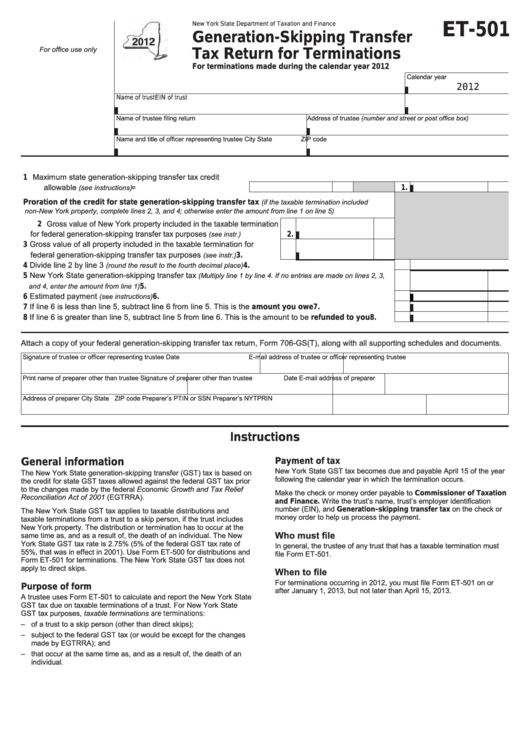

ET-501

New York State Department of Taxation and Finance

Generation-Skipping Transfer

For office use only

Tax Return for Terminations

For terminations made during the calendar year 2012

Calendar year

2012

Name of trust

EIN of trust

Name of trustee filing return

Address of trustee (number and street or post office box)

Name and title of officer representing trustee

City

State

ZIP code

1 Maximum state generation‑skipping transfer tax credit

allowable

(see instructions)

.....................................................

x 0.0275 =

1.

(if the taxable termination included

Proration of the credit for state generation-skipping transfer tax

non-New York property, complete lines 2, 3, and 4; otherwise enter the amount from line 1 on line 5)

2 Gross value of New York property included in the taxable termination

for federal generation‑skipping transfer tax purposes

(see instr.)

......

2.

3 Gross value of all property included in the taxable termination for

federal generation‑skipping transfer tax purposes

(see instr.)

........

3.

4 Divide line 2 by line 3

(round the result to the fourth decimal place)

............................................................

4.

5 New York State generation‑skipping transfer tax

(Multiply line 1 by line 4. If no entries are made on lines 2, 3,

and 4, enter the amount from line 1)

.............................................................................................................

5.

6 Estimated payment

(see instructions)

...........................................................................................................

6.

7 If line 6 is less than line 5, subtract line 6 from line 5. This is the amount you owe .................................

7.

8 If line 6 is greater than line 5, subtract line 5 from line 6. This is the amount to be refunded to you .......

8.

Attach a copy of your federal generation‑skipping transfer tax return, Form 706‑GS(T), along with all supporting schedules and documents.

Signature of trustee or officer representing trustee

Date

E‑mail address of trustee or officer representing trustee

Print name of preparer other than trustee

Signature of preparer other than trustee

Date

E‑mail address of preparer

Address of preparer

City

State ZIP code

Preparer’s PTIN or SSN

Preparer’s NYTPRIN

Instructions

Payment of tax

General information

New York State GST tax becomes due and payable April 15 of the year

The New York State generation‑skipping transfer (GST) tax is based on

following the calendar year in which the termination occurs.

the credit for state GST taxes allowed against the federal GST tax prior

to the changes made by the federal Economic Growth and Tax Relief

Make the check or money order payable to Commissioner of Taxation

Reconciliation Act of 2001 (EGTRRA).

and Finance. Write the trust’s name, trust’s employer identification

number (EIN), and Generation‑skipping transfer tax on the check or

The New York State GST tax applies to taxable distributions and

money order to help us process the payment.

taxable terminations from a trust to a skip person, if the trust includes

New York property. The distribution or termination has to occur at the

Who must file

same time as, and as a result of, the death of an individual. The New

York State GST tax rate is 2.75% (5% of the federal GST tax rate of

In general, the trustee of any trust that has a taxable termination must

55%, that was in effect in 2001). Use Form ET‑500 for distributions and

file Form ET‑501.

Form ET‑501 for terminations. The New York State GST tax does not

apply to direct skips.

When to file

For terminations occurring in 2012, you must file Form ET‑501 on or

Purpose of form

after January 1, 2013, but not later than April 15, 2013.

A trustee uses Form ET‑501 to calculate and report the New York State

GST tax due on taxable terminations of a trust. For New York State

GST tax purposes, taxable terminations are terminations:

– of a trust to a skip person (other than direct skips);

– subject to the federal GST tax (or would be except for the changes

made by EGTRRA); and

– that occur at the same time as, and as a result of, the death of an

individual.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2