Form Ri 2441 - Computation Of Daycare Assistance And Development Tax Credit

ADVERTISEMENT

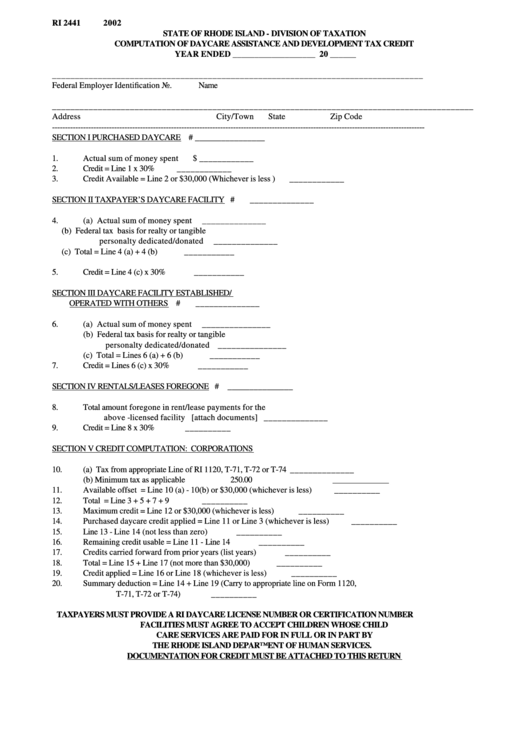

RI 2441

2002

STATE OF RHODE ISLAND - DIVISION OF TAXATION

COMPUTATION OF DAYCARE ASSISTANCE AND DEVELOPMENT TAX CREDIT

YEAR ENDED ___________________ 20 ______

_______________________________________

__________________________________________

Federal Employer Identification No.

Name

____________________________________________________________________________________________

Address

City/Town

State

Zip Code

------------------------------------------------------------------------------------------------------------------------------------------------

SECTION I PURCHASED DAYCARE

R.I. Daycare Lic/Cert # ________________

1.

Actual sum of money spent

$ ____________

2.

Credit = Line 1 x 30%

____________

3.

Credit Available = Line 2 or $30,000 (Whichever is less )

____________

SECTION II TAXPAYER’S DAYCARE FACILITY

R.I. Daycare Lic/Cert #

______________

4.

(a) Actual sum of money spent

______________

(b) Federal tax basis for realty or tangible

personalty dedicated/donated

______________

(c) Total = Line 4 (a) + 4 (b)

___________

5.

Credit = Line 4 (c) x 30%

___________

SECTION III DAYCARE FACILITY ESTABLISHED/

OPERATED WITH OTHERS

R.I. Daycare Lic/Cert #

______________

6.

(a) Actual sum of money spent

_______________

(b) Federal tax basis for realty or tangible

personalty dedicated/donated

_______________

(c) Total = Lines 6 (a) + 6 (b)

___________

7.

Credit = Lines 6 (c) x 30%

___________

SECTION IV RENTALS/LEASES FOREGONE

R.I. Daycare Lic/Cert # _______________

8.

Total amo unt foregone in rent/lease payments for the

above -licensed facility [attach documents]

______________

9.

Credit = Line 8 x 30%

__________

SECTION V CREDIT COMPUTATION: CORPORATIONS

10.

(a) Tax from appropriate Line of RI 1120, T-71, T-72 or T-74

______________

(b) Minimum tax as applicable

250.00

11.

Available offset = Line 10 (a) - 10(b) or $30,000 (whichever is less)

__________

12.

Total = Line 3 + 5 + 7 + 9

__________

13.

Maximum credit = Line 12 or $30,000 (whichever is less)

__________

14.

Purchased daycare credit applied = Line 11 or Line 3 (whichever is less)

__________

15.

Line 13 - Line 14 (not less than zero)

__________

16.

Remaining credit usable = Line 11 - Line 14

__________

17.

Credits carried forward from prior years (list years)

__________

18.

Total = Line 15 + Line 17 (not more than $30,000)

__________

19.

Credit applied = Line 16 or Line 18 (whichever is less)

__________

20.

Summary deduction = Line 14 + Line 19 (Carry to appropriate line on Form 1120,

T-71, T-72 or T-74)

__________

TAXPAYERS MUST PROVIDE A RI DAYCARE LICENSE NUMBER OR CERTIFICATION NUMBER R.I. CHIDCARE

FACILITIES MUST AGREE TO ACCEPT CHILDREN WHOSE CHILD

CARE SERVICES ARE PAID FOR IN FULL OR IN PART BY

THE RHODE ISLAND DEPARTMENT OF HUMAN SERVICES.

DOCUMENTATION FOR CREDIT MUST BE ATTACHED TO THIS RETURN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1