Form Ri 5009 - Computation Of Educational Assistance And Development Tax Credit

ADVERTISEMENT

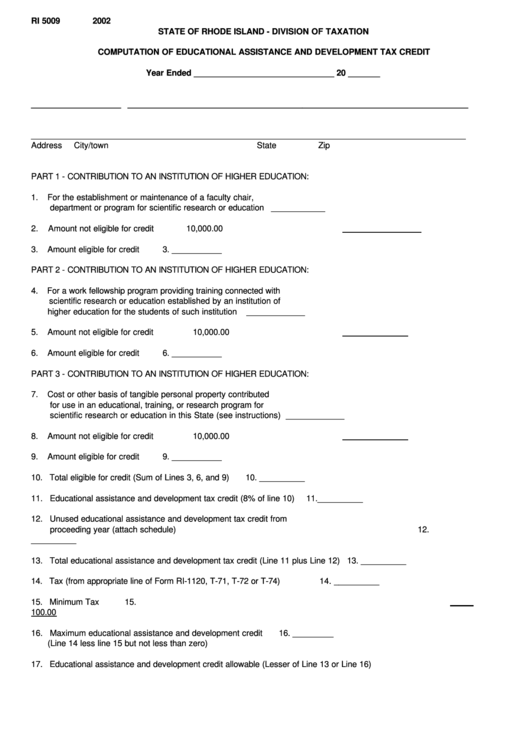

RI 5009

2002

STATE OF RHODE ISLAND - DIVISION OF TAXATION

COMPUTATION OF EDUCATIONAL ASSISTANCE AND DEVELOPMENT TAX CREDIT

Year Ended _______________________________ 20 _______

____________________ ____________________________________________________________________________

F.E.I.

No.

Name

_________________________________________________________________________________________________

Address

City/town

State

Zip

PART 1 - CONTRIBUTION TO AN INSTITUTION OF HIGHER EDUCATION:

1.

For the establishment or maintenance of a faculty chair,

department or program for scientific research or education

____________

2.

Amount not eligible for credit

10,000.00

3.

Amount eligible for credit

3. ___________

PART 2 - CONTRIBUTION TO AN INSTITUTION OF HIGHER EDUCATION:

4.

For a work fellowship program providing training connected with

scientific research or education established by an institution of

higher education for the students of such institution

_____________

5.

Amount not eligible for credit

10,000.00

6.

Amount eligible for credit

6. ___________

PART 3 - CONTRIBUTION TO AN INSTITUTION OF HIGHER EDUCATION:

7.

Cost or other basis of tangible personal property contributed

for use in an educational, training, or research program for

scientific research or education in this State (see instructions)

_____________

8.

Amount not eligible for credit

10,000.00

9.

Amount eligible for credit

9. ___________

10. Total eligible for credit (Sum of Lines 3, 6, and 9)

10. __________

11. Educational assistance and development tax credit (8% of line 10)

11.__________

12. Unused educational assistance and development tax credit from

proceeding year (attach schedule)

12.

__________

13. Total educational assistance and development tax credit (Line 11 plus Line 12)

13. __________

14. Tax (from appropriate line of Form RI-1120, T-71, T-72 or T-74)

14. __________

15. Minimum Tax

15.

100.00

16. Maximum educational assistance and development credit

16. _________

(Line 14 less line 15 but not less than zero)

17. Educational assistance and development credit allowable (Lesser of Line 13 or Line 16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2