Form C-5 - Adjustment Report

Download a blank fillable Form C-5 - Adjustment Report in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form C-5 - Adjustment Report with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

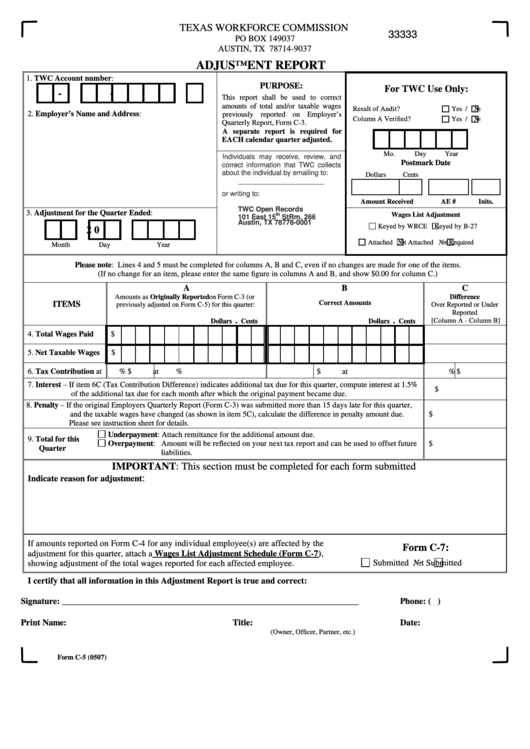

TEXAS WORKFORCE COMMISSION

33333

PO BOX 149037

AUSTIN, TX 78714-9037

ADJUSTMENT REPORT

1. TWC Account number:

PURPOSE:

For TWC Use Only:

-

-

This report shall be used to correct

amounts of total and/or taxable wages

Result of Audit?

Yes /

No

2. Employer’s Name and Address:

previously reported on Employer’s

Column A Verified?

Yes /

No

Quarterly Report, Form C-3.

A separate report is required for

EACH calendar quarter adjusted.

Mo.

Day

Year

Individuals may receive, review, and

Postmark Date

correct information that TWC collects

about the individual by emailing to:

Dollars

Cents

open.records@twc.state.tx.us

or writing to:

Amount Received

AE #

Inits.

TWC Open Records

3. Adjustment for the Quarter Ended:

Wages List Adjustment

th

101 East 15

St Rm. 266

Austin, TX 78778-0001

Keyed by WRCE

Keyed by B-27

2 0

Attached

Not Attached

Not Required

Month

Day

Year

Please note: Lines 4 and 5 must be completed for columns A, B and C, even if no changes are made for one of the items.

(If no change for an item, please enter the same figure in columns A and B, and show $0.00 for column C.)

A

B

C

Amounts as Originally Reported on Form C-3 (or

Difference

Correct Amounts

ITEMS

previously adjusted on Form C-5) for this quarter:

Over Reported or Under

Reported

.

.

[Column A - Column B]

Dollars

Cents__

Dollars

Cents__

4. Total Wages Paid

$

5. Net Taxable Wages

$

6. Tax Contribution

at

% $

at

% $

at

% $

7. Interest – If item 6C (Tax Contribution Difference) indicates additional tax due for this quarter, compute interest at 1.5%

$

of the additional tax due for each month after which the original payment became due.

8. Penalty – If the original Employers Quarterly Report (Form C-3) was submitted more than 15 days late for this quarter,

and the taxable wages have changed (as shown in item 5C), calculate the difference in penalty amount due.

$

Please see instruction sheet for details.

Underpayment: Attach remittance for the additional amount due.

9. Total for this

Overpayment: Amount will be reflected on your next tax report and can be used to offset future

$

Quarter

liabilities.

IMPORTANT: This section must be completed for each form submitted

:

Indicate reason for adjustment

If amounts reported on Form C-4 for any individual employee(s) are affected by the

Form C-7:

adjustment for this quarter, attach a Wages List Adjustment Schedule (Form C-7),

Submitted

Not Submitted

showing adjustment of the total wages reported for each affected employee.

I certify that all information in this Adjustment Report is true and correct:

Signature: ___________________________________________________________________

Phone: (

)

Print Name:

Title:

Date:

(Owner, Officer, Partner, etc.)

Form C-5 (0507)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1