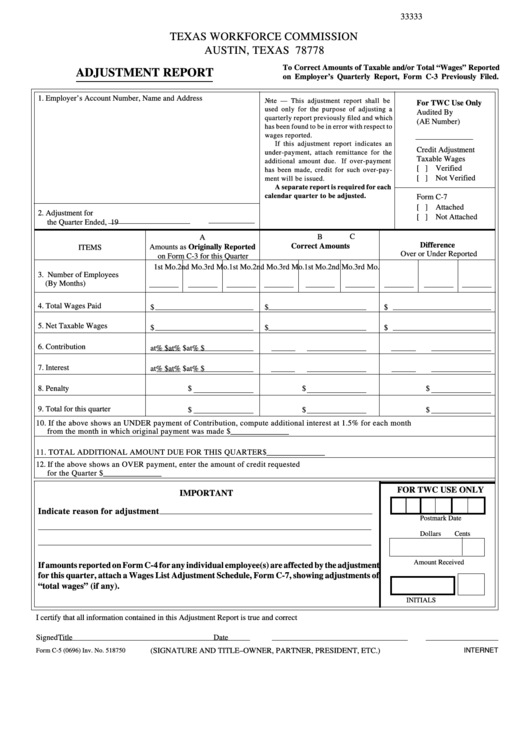

Form C-5 - Adjustment Report - Texas Workforce Commission

ADVERTISEMENT

33333

TEXAS WORKFORCE COMMISSION

AUSTIN, TEXAS 78778

To Correct Amounts of Taxable and/or Total “Wages” Reported

ADJUSTMENT REPORT

on Employer’s Quarterly Report, Form C-3 Previously Filed.

1. Employer’s Account Number, Name and Address

Note — This adjustment report shall be

For TWC Use Only

used only for the purpose of adjusting a

Audited By

quarterly report previously filed and which

(AE Number)

has been found to be in error with respect to

wages reported.

If this adjustment report indicates an

Credit Adjustment

under-payment, attach remittance for the

Taxable Wages

additional amount due. If over-payment

[ ] Verified

has been made, credit for such over-pay-

[ ] Not Verified

ment will be issued.

A separate report is required for each

calendar quarter to be adjusted.

Form C-7

[ ] Attached

2. Adjustment for

[ ] Not Attached

the Quarter Ended

, 19

B

C

A

Difference

Correct Amounts

Amounts as Originally Reported

ITEMS

Over or Under Reported

on Form C-3 for this Quarter

1st Mo.

2nd Mo.

3rd Mo.

1st Mo.

2nd Mo.

3rd Mo.

1st Mo.

2nd Mo.

3rd Mo.

3. Number of Employees

(By Months)

4. Total Wages Paid

$

$

$

5. Net Taxable Wages

$

$

$

6. Contribution

at

% $

at

% $

at

% $

7. Interest

at

% $

at

% $

at

% $

8. Penalty

$

$

$

9. Total for this quarter

$

$

$

10. If the above shows an UNDER payment of Contribution, compute additional interest at 1.5% for each month

from the month in which original payment was made ..................................................................................................... $ _______________

11. TOTAL ADDITIONAL AMOUNT DUE FOR THIS QUARTER .................................................................................. $ _______________

12. If the above shows an OVER payment, enter the amount of credit requested

for the Quarter ...................................................................................................................................................................... $ _______________

FOR TWC USE ONLY

IMPORTANT

Indicate reason for adjustment

Postmark Date

Dollars

Cents

Amount Received

If amounts reported on Form C-4 for any individual employee(s) are affected by the adjustment

for this quarter, attach a Wages List Adjustment Schedule, Form C-7, showing adjustments of

“total wages” (if any).

A.E. ID No.

INITIALS

I certify that all information contained in this Adjustment Report is true and correct

Signed

Title

Date

(SIGNATURE AND TITLE–OWNER, PARTNER, PRESIDENT, ETC.)

INTERNET

Form C-5 (0696) Inv. No. 518750

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1