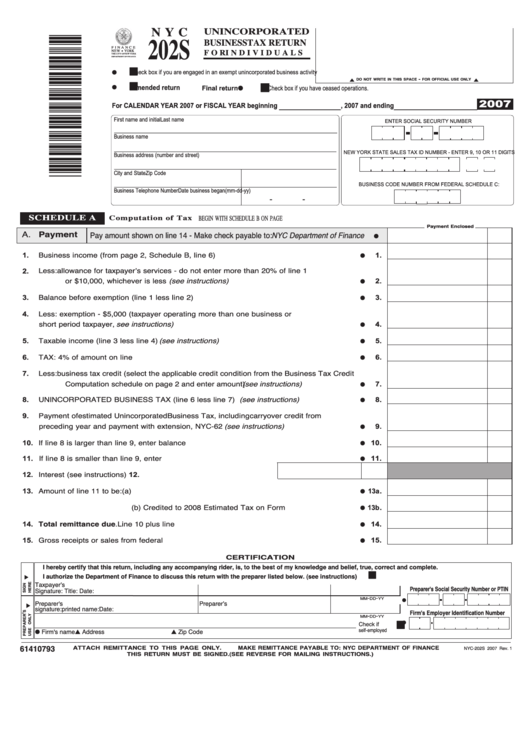

202S

N Y C

UNINCORPORATED

BUSINESS TAX RETURN

F O R I N D I V I D U A L S

F I N A N C E

NEW

YORK

G

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

I I

Check box if you are engaged in an exempt unincorporated business activity

G

-

I I

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

I I

L

L

Amended return

Final return G

Check box if you have ceased operations.

G

2007

For CALENDAR YEAR 2007 or FISCAL YEAR beginning _________________ , 2007 and ending _______________________

First name and initial

Last name

ENTER SOCIAL SECURITY NUMBER

Business name

NEW YORK STATE SALES TAX ID NUMBER - ENTER 9, 10 OR 11 DIGITS

Business address (number and street)

City and State

Zip Code

BUSINESS CODE NUMBER FROM FEDERAL SCHEDULE C:

Business Telephone Number

Date business began (mm-dd-yy)

SCHEDULE A

BEGIN WITH SCHEDULE B ON PAGE 2. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Computation of Tax

Payment Enclosed

A. Payment

Pay amount shown on line 14 - Make check payable to: NYC Department of Finance

G

Business income (from page 2, Schedule B, line 6) .................................................................

1.

1.

G

Less:

allowance for taxpayerʼs services - do not enter more than 20% of line 1

2.

or $10,000, whichever is less (see instructions) ...........................................................

2.

G

Balance before exemption (line 1 less line 2) ...........................................................................

3.

3.

G

Less: exemption - $5,000 (taxpayer operating more than one business or

4.

short period taxpayer, see instructions) .....................................................................................

4.

G

Taxable income (line 3 less line 4) (see instructions) ................................................................

5.

5.

G

TAX: 4% of amount on line 5.....................................................................................................

6.

6.

G

Less:

business tax credit (select the applicable credit condition from the Business Tax Credit

7.

Computation schedule on page 2 and enter amount) (see instructions) ..........................

7.

G

UNINCORPORATED BUSINESS TAX (line 6 less line 7) (see instructions) ...........................

8.

8.

G

Payment of estimated Unincorporated Business Tax, including carryover credit from

9.

preceding year and payment with extension, NYC-62 (see instructions) .................................

9.

G

10. If line 8 is larger than line 9, enter balance due .......................................................................

10.

G

11. If line 8 is smaller than line 9, enter overpayment ..................................................................

11.

G

12. Interest (see instructions) ..............................................................12.

13. Amount of line 11 to be:

(a) Refunded ..................................................................................

13a.

G

(b) Credited to 2008 Estimated Tax on Form NYC-5UBTI ............

13b.

G

14. Total remittance due. Line 10 plus line 12. Enter payment amount on line A above ..........

14.

G

15. Gross receipts or sales from federal return ...............................................................................

15.

G

C E R T I F I C AT I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I I

I authorize the Department of Finance to discuss this return with the preparer listed below. (see instructions) ..................................................................... YES

Taxpayerʼs

Preparer's Social Security Number or PTIN

Signature:

Title:

Date:

-

-

Preparer's

Preparerʼs

MM

DD

YY

G

signature:

printed name:

Date:

Firm's Employer Identification Number

-

-

MM

DD

YY

I I

Check if

G

G Firm's name

L Address

L Zip Code

self-employed

61410793

AT TA C H R E M I T TA N C E TO T H I S PA G E O N LY.

MAKE REMITTANCE PAYABLE TO: NYC DEPARTMENT OF FINANCE

NYC-202S 2007 Rev. 1

THIS RETURN MUST BE SIGNED. (SEE REVERSE FOR MAILING INSTRUCTIONS.)

1

1 2

2