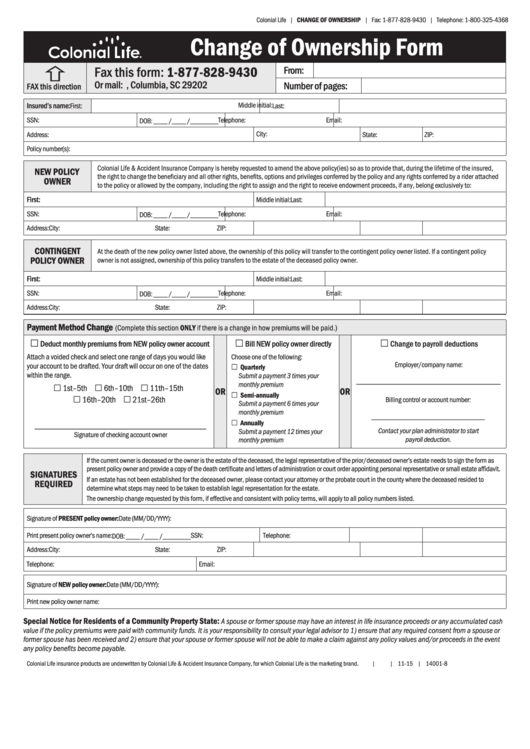

Colonial Life | CHANGE OF OWNERSHIP | Fax: 1-877-828-9430 | Telephone: 1-800-325-4368

Change of Ownership Form

Fax this form: 1-877-828-9430

From:

Or mail: P.O. Box 100130, Columbia, SC 29202

Number of pages:

FAX this direction

Insured’s name:

Middle initial:

First:

Last:

SSN:

Telephone:

Email:

DOB: ____ /____ /________

City:

Address:

State:

ZIP:

Policy number(s):

Colonial Life & Accident Insurance Company is hereby requested to amend the above policy(ies) so as to provide that, during the lifetime of the insured,

NEW POLICY

the right to change the beneficiary and all other rights, benefits, options and privileges conferred by the policy and any rights conferred by a rider attached

OWNER

to the policy or allowed by the company, including the right to assign and the right to receive endowment proceeds, if any, belong exclusively to:

First:

Middle initial:

Last:

SSN:

Telephone:

Email:

DOB: ____ /____ /________

Address:

City:

State:

ZIP:

CONTINGENT

At the death of the new policy owner listed above, the ownership of this policy will transfer to the contingent policy owner listed. If a contingent policy

POLICY OWNER

owner is not assigned, ownership of this policy transfers to the estate of the deceased policy owner.

First:

Middle initial:

Last:

SSN:

Telephone:

Email:

DOB: ____ /____ /________

Address:

City:

State:

ZIP:

Payment Method Change

(Complete this section ONLY if there is a change in how premiums will be paid.)

£

Deduct monthly premiums from NEW policy owner account

£

Bill NEW policy owner directly

£

Change to payroll deductions

Attach a voided check and select one range of days you would like

Choose one of the following:

Employer/company name:

your account to be drafted. Your draft will occur on one of the dates

£ Quarterly

within the range.

Submit a payment 3 times your

__________________________________________

monthly premium

£ 1st–5th £ 6th–10th £ 11th–15th

OR

OR

£ Semi-annually

£ 16th–20th £ 21st–26th

Billing control or account number:

Submit a payment 6 times your

monthly premium

_________________________________

£ Annually

__________________________________________________

Contact your plan administrator to start

Submit a payment 12 times your

Signature of checking account owner

payroll deduction.

monthly premium

If the current owner is deceased or the owner is the estate of the deceased, the legal representative of the prior/deceased owner’s estate needs to sign the form as

present policy owner and provide a copy of the death certificate and letters of administration or court order appointing personal representative or small estate affidavit.

SIGNATURES

If an estate has not been established for the deceased owner, please contact your attorney or the probate court in the county where the deceased resided to

REQUIRED

determine what steps may need to be taken to establish legal representation for the estate.

The ownership change requested by this form, if effective and consistent with policy terms, will apply to all policy numbers listed.

Signature of PRESENT policy owner:

Date (MM/DD/YYYY):

Print present policy owner’s name:

SSN:

Telephone:

DOB: ____ /____ /________

Address:

City:

State:

ZIP:

Telephone:

Email:

Signature of NEW policy owner:

Date (MM/DD/YYYY):

Print new policy owner name:

Special Notice for Residents of a Community Property State:

A spouse or former spouse may have an interest in life insurance proceeds or any accumulated cash

value if the policy premiums were paid with community funds. It is your responsibility to consult your legal advisor to 1) ensure that any required consent from a spouse or

former spouse has been received and 2) ensure that your spouse or former spouse will not be able to make a claim against any policy values and/or proceeds in the event

any policy benefits become payable.

Colonial Life insurance products are underwritten by Colonial Life & Accident Insurance Company, for which Colonial Life is the marketing brand.

|

| 11-15 | 14001-8

1

1