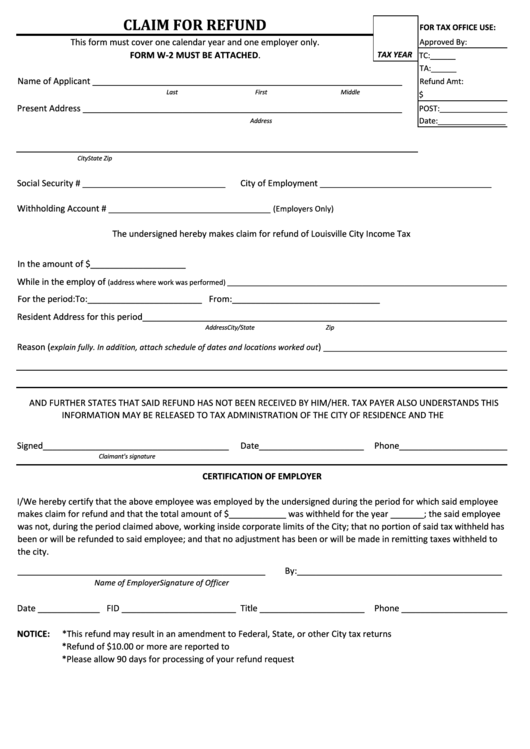

CLAIM FOR REFUND

FOR TAX OFFICE USE:

This form must cover one calendar year and one employer only.

Approved By:

FORM W-2 MUST BE ATTACHED.

TAX YEAR TC:______

TA:______

Name of Applicant _________________________________________________________________

Refund Amt:

Last

First

Middle

$

Present Address ___________________________________________________________________

POST:________________

Address

Date:________________

City

State

Zip

Social Security # ______________________________

City of Employment ____________________________________

Withholding Account # __________________________________

(Employers Only)

The undersigned hereby makes claim for refund of Louisville City Income Tax

In the amount of $____________________

While in the employ of

(address where work was performed) _________________________________________________________________________

For the period:

To:________________________ From:_______________________________

Resident Address for this period_____________________________________________________________________________

Address

City/State

Zip

Reason (

) _______________________________________

explain fully. In addition, attach schedule of dates and locations worked out

AND FURTHER STATES THAT SAID REFUND HAS NOT BEEN RECEIVED BY HIM/HER. TAX PAYER ALSO UNDERSTANDS THIS

INFORMATION MAY BE RELEASED TO TAX ADMINISTRATION OF THE CITY OF RESIDENCE AND THE I.R.S.

Signed_______________________________________

Date______________________

Phone_______________________

Claimant's signature

CERTIFICATION OF EMPLOYER

I/We hereby certify that the above employee was employed by the undersigned during the period for which said employee

makes claim for refund and that the total amount of $____________ was withheld for the year _______; the said employee

was not, during the period claimed above, working inside corporate limits of the City; that no portion of said tax withheld has

been or will be refunded to said employee; and that no adjustment has been or will be made in remitting taxes withheld to

the city.

____________________________________________________

By:___________________________________________

Name of Employer

Signature of Officer

Date _____________ FID ________________________ Title ______________________ Phone _______________________

NOTICE:

*This refund may result in an amendment to Federal, State, or other City tax returns

*Refund of $10.00 or more are reported to I.R.S.

*Please allow 90 days for processing of your refund request

1

1 2

2