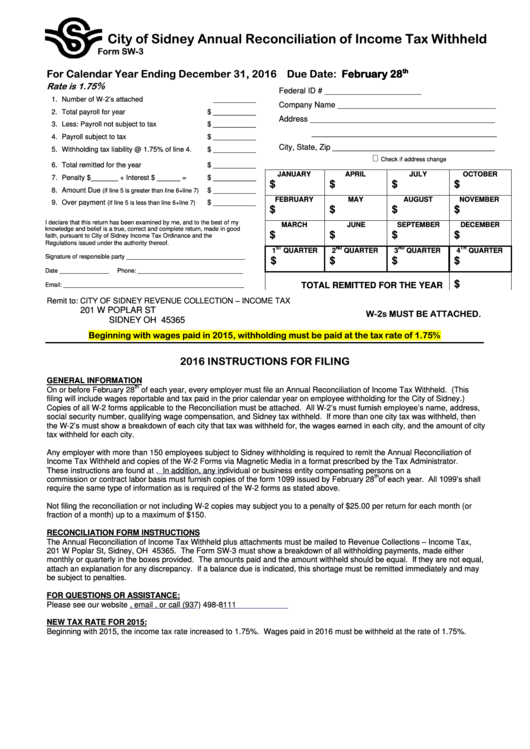

City of Sidney Annual Reconciliation of Income Tax Withheld

Form SW-3

th

For Calendar Year Ending December 31, 2016

Due Date: February 28

%

Rate is 1.75

Federal ID # ______________________

1. Number of W-2’s attached

___________

Company Name ____________________________________

2. Total payroll for year

$ ___________

Address __________________________________________

3. Less: Payroll not subject to tax

$ ___________

__________________________________________

4. Payroll subject to tax

$ ___________

City, State, Zip _____________________________________

5. Withholding tax liability @ 1.75% of line 4.

$ ___________

Check if address change

6. Total remitted for the year

$ ___________

JANUARY

APRIL

JULY

OCTOBER

7. Penalty $_______ + Interest $ ______ =

$ ___________

$

$

$

$

8. Amount Due

$ ___________

(if line 5 is greater than line 6+line 7)

FEBRUARY

MAY

AUGUST

NOVEMBER

9. Over payment

$ ___________

(if line 5 is less than line 6+line 7)

$

$

$

$

I declare that this return has been examined by me, and to the best of my

MARCH

JUNE

SEPTEMBER

DECEMBER

knowledge and belief is a true, correct and complete return, made in good

$

$

$

$

faith, pursuant to City of Sidney Income Tax Ordinance and the

Regulations issued under the authority thereof.

ST

ND

RD

TH

1

QUARTER

2

QUARTER

3

QUARTER

4

QUARTER

Signature of responsible party ____________________________________

$

$

$

$

Date _______________

Phone: ________________________________

$

TOTAL REMITTED FOR THE YEAR

Email: _______________________________________________________

CITY OF SIDNEY REVENUE COLLECTION – INCOME TAX

Remit to:

201 W POPLAR ST

W-2s MUST BE ATTACHED.

SIDNEY OH 45365

Beginning with wages paid in 2015, withholding must be paid at the tax rate of 1.75%

2016 INSTRUCTIONS FOR FILING

GENERAL INFORMATION

th

On or before February 28

of each year, every employer must file an Annual Reconciliation of Income Tax Withheld. (This

filing will include wages reportable and tax paid in the prior calendar year on employee withholding for the City of Sidney.)

Copies of all W-2 forms applicable to the Reconciliation must be attached. All W-2’s must furnish employee’s name, address,

social security number, qualifying wage compensation, and Sidney tax withheld. If more than one city tax was withheld, then

the W-2’s must show a breakdown of each city that tax was withheld for, the wages earned in each city, and the amount of city

tax withheld for each city.

Any employer with more than 150 employees subject to Sidney withholding is required to remit the Annual Reconciliation of

Income Tax Withheld and copies of the W-2 Forms via Magnetic Media in a format prescribed by the Tax Administrator.

These instructions are found at In addition, any individual or business entity compensating persons on a

th

of each year. All 1099’s shall

commission or contract labor basis must furnish copies of the form 1099 issued by February 28

require the same type of information as is required of the W-2 forms as stated above.

Not filing the reconciliation or not including W-2 copies may subject you to a penalty of $25.00 per return for each month (or

fraction of a month) up to a maximum of $150.

RECONCILIATION FORM INSTRUCTIONS

The Annual Reconciliation of Income Tax Withheld plus attachments must be mailed to Revenue Collections – Income Tax,

201 W Poplar St, Sidney, OH 45365. The Form SW-3 must show a breakdown of all withholding payments, made either

monthly or quarterly in the boxes provided. The amounts paid and the amount withheld should be equal. If they are not equal,

attach an explanation for any discrepancy. If a balance due is indicated, this shortage must be remitted immediately and may

be subject to penalties.

FOR QUESTIONS OR ASSISTANCE:

Please see our website , email , or call (937) 498-8111

NEW TAX RATE FOR 2015:

Beginning with 2015, the income tax rate increased to 1.75%. Wages paid in 2016 must be withheld at the rate of 1.75%.

1

1