Form 15g - Declaration Under Section 197a(1) And Section 197a(1a)

ADVERTISEMENT

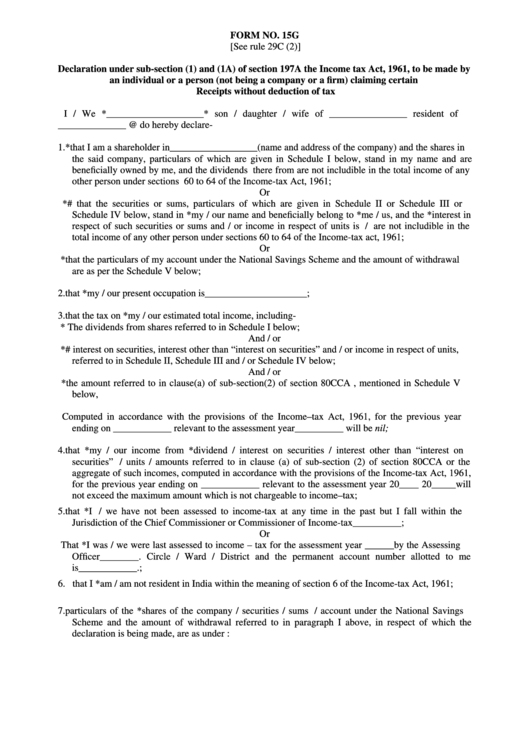

FORM NO. 15G

[See rule 29C (2)]

Declaration under sub-section (1) and (1A) of section 197A the Income tax Act, 1961, to be made by

an individual or a person (not being a company or a firm) claiming certain

Receipts without deduction of tax

I / We *____________________* son / daughter / wife of ________________ resident of

______________ @ do hereby declare-

1. *that I am a shareholder in__________________(name and address of the company) and the shares in

the said company, particulars of which are given in Schedule I below, stand in my name and are

beneficially owned by me, and the dividends there from are not includible in the total income of any

other person under sections 60 to 64 of the Income-tax Act, 1961;

Or

*# that the securities or sums, particulars of which are given in Schedule II or Schedule III or

Schedule IV below, stand in *my / our name and beneficially belong to *me / us, and the *interest in

respect of such securities or sums and / or income in respect of units is / are not includible in the

total income of any other person under sections 60 to 64 of the Income-tax act, 1961;

Or

*that the particulars of my account under the National Savings Scheme and the amount of withdrawal

are as per the Schedule V below;

2. that *my / our present occupation is_____________________;

3. that the tax on *my / our estimated total income, including-

* The dividends from shares referred to in Schedule I below;

And / or

*# interest on securities, interest other than “interest on securities” and / or income in respect of units,

referred to in Schedule II, Schedule III and / or Schedule IV below;

And / or

*the amount referred to in clause(a) of sub-section(2) of section 80CCA , mentioned in Schedule V

below,

Computed in accordance with the provisions of the Income–tax Act, 1961, for the previous year

ending on ____________ relevant to the assessment year__________ will be nil;

4. that *my / our income from *dividend / interest on securities / interest other than “interest on

securities” / units / amounts referred to in clause (a) of sub-section (2) of section 80CCA or the

aggregate of such incomes, computed in accordance with the provisions of the Income-tax Act, 1961,

for the previous year ending on ____________ relevant to the assessment year 20____ 20_____will

not exceed the maximum amount which is not chargeable to income–tax;

5. that *I / we have not been assessed to income-tax at any time in the past but I fall within the

Jurisdiction of the Chief Commissioner or Commissioner of Income-tax__________;

Or

That *I was / we were last assessed to income – tax for the assessment year ______by the Assessing

Officer________. Circle / Ward / District and the permanent account number allotted to me

is____________.;

6. that I *am / am not resident in India within the meaning of section 6 of the Income-tax Act, 1961;

7. particulars of the *shares of the company / securities / sums / account under the National Savings

Scheme and the amount of withdrawal referred to in paragraph I above, in respect of which the

declaration is being made, are as under :

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4