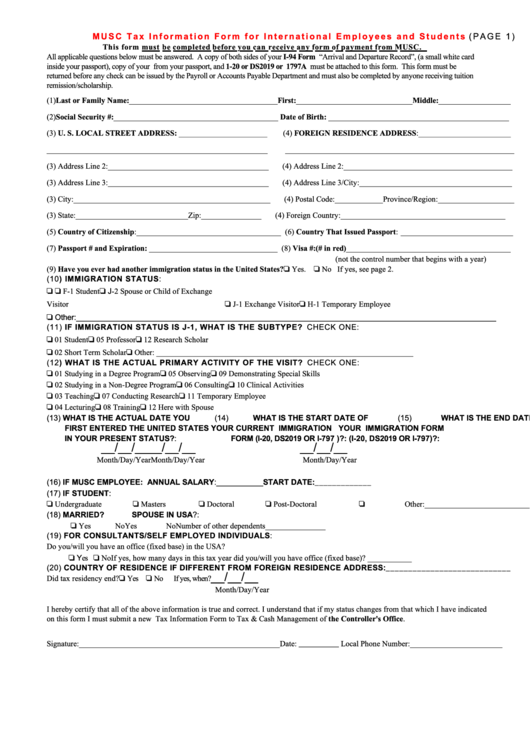

M U S C T a x I n f o r m a t i o n F o r m f o r I n t e r n a t i o n a l E m p l o y e e s a n d S t u d e n t s

( P A G E 1 )

This form must be completed before you can receive any form of payment from MUSC.

All applicable questions below must be answered. A copy of both sides of your I-94 Form “Arrival and Departure Record”, (a small white card

inside your passport), copy of your U.S. VISA from your passport, and 1-20 or DS2019 or 1797A must be attached to this form. This form must be

returned before any check can be issued by the Payroll or Accounts Payable Department and must also be completed by anyone receiving tuition

remission/scholarship.

(1)Last or Family Name: _____________________________________First:_____________________________Middle:__________________

(2)Social Security #: _________________________________________ Date of Birth: _____________________________________________

(3) U. S. LOCAL STREET ADDRESS: ______________________

(4) FOREIGN RESIDENCE ADDRESS:_______________________

_______________________________________________________

_________________________________________________________

(3) Address Line 2: ________________________________________

(4) Address Line 2:__________________________________________

(3) Address Line 3: ________________________________________

(4) Address Line 3/City:______________________________________

(3) City:_________________________________________________

(4) Postal Code:____________Province/Region:___________________

(3) State: ____________________________ Zip: _______________

(4) Foreign Country:_________________________________________

(5) Country of Citizenship:____________________________________ (6) Country That Issued Passport: ____________________________

(7) Passport # and Expiration: ________________________________ (8) Visa #:(# in red)_________________________________________

(not the control number that begins with a year)

(9) Have you ever had another immigration status in the United States?

Yes.

No If yes, see page 2.

(10) IMMIGRATION STATUS:

J-2 Spouse or Child of Exchange

U.S. Immigrant/Permanent Resident

F-1 Student

Visitor

J-1 Exchange Visitor

H-1 Temporary Employee

Other: ___________________________________________________________________________________________________

(11) IF IMMIGRATION STATUS IS J-1, WHAT IS THE SUBTYPE? CHECK ONE:

01 Student

05 Professor

12 Research Scholar

02 Short Term Scholar

Other: ________________________________________________________________

(12) WHAT IS THE ACTUAL PRIMARY ACTIVITY OF THE VISIT? CHECK ONE:

01 Studying in a Degree Program

05 Observing

09 Demonstrating Special Skills

02 Studying in a Non-Degree Program

06 Consulting

10 Clinical Activities

03 Teaching

07 Conducting Research

11 Temporary Employee

04 Lecturing

08 Training

12 Here with Spouse

(13) WHAT IS THE ACTUAL DATE YOU

(14) WHAT IS THE START DATE OF

(15) WHAT IS THE END DATE OF

FIRST ENTERED THE UNITED STATES

YOUR CURRENT IMMIGRATION

YOUR IMMIGRATION FORM

IN YOUR PRESENT STATUS?:

FORM (I-20, DS2019 OR I-797 )?:

(I-20, DS2019 OR I-797)?:

__/__/__

__/__/__

__/__/__

Month/Day/Year

Month/Day/Year

Month/Day/Year

(16) IF MUSC EMPLOYEE: ANNUAL SALARY:___________START DATE:_____________

(17) IF STUDENT:

Undergraduate

Masters

Doctoral

Post-Doctoral

Other:_____________________________

(18) MARRIED?

SPOUSE IN USA?:

Yes

No

Yes

No

Number of other dependents_______________

(19) FOR CONSULTANTS/SELF EMPLOYED INDIVIDUALS:

Do you/will you have an office (fixed base) in the USA?

es

No If yes, how many days in this tax year did you/will you have office (fixed base)? ___________

(20) COUNTRY OF RESIDENCE IF DIFFERENT FROM FOREIGN RESIDENCE ADDRESS:____________________________

__/__/__

Did tax residency end?

Yes

No

If yes, when?

Month/Day/Year

I hereby certify that all of the above information is true and correct. I understand that if my status changes from that which I have indicated

on this form I must submit a new Tax Information Form to Tax & Cash Management of the Controller's Office .

Signature: __________________________________________________ Date: __________ Local Phone Number: _______________________

1

1 2

2