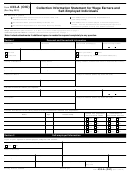

M U S C T a x I n f o r m a t i o n F o r m f o r I n t e r n a t i o n a l E m p l o y e e s a n d S t u d e n t s

( P A G E 2 )

This form must be completed before you can receive any form of payment.

PLEASE LIST ANY VISA IMMIGRATION ACTIVITY IN LAST THREE CALENDAR YEARS AND ALL F,J,M OR Q VISAS SINCE

1/1/85:

Date of Entry

Date of Exit

Visa Immigration Status

J-1 Subtype

Purpose of Stay

Have You Taken Any

(if applicable)

Treaty Benefits

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

Yes

No

_________________

__________________

_____________________

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

__/__/__

__/__/__

_________________

__________________

_____________________

Yes

No

I hereby certify that all of the above information is true and correct. I understand that if my status changes from that which I have indicated

on this form I must submit a new Tax Information Form to the Tax & Cash Management of the Controller's Office.

Signature: __________________________________________________ Date: _____________________________

HOW TO COMPLETE THE MUSC TAX INFORMATION FORM FOR INTERNATIONALS:

1. Name: List full name.

2. Social Security Number: Enter US social security number issued by the US Social Security Administration not your ID number. Do not list numbers not

assigned by the United States Social Security, i.e. Canadian social security number. All employees must have a social security number in order to work.

If none enter your ITIN issued by the IRS.

3. Local Street Address: List your local US address.

4. Residence: List your non US address.

5. Country of Citizenship(s)

6. Country that Issued Passport: List Country in which you were issued your passport. Not the country where it was issued.

7. Passport # and Expiration: Enter your passport number and its expiration date.

8. Visa #: Enter your Visa number.

9. Immigration Status: Check yes or no. If yes, complete the above form for the time you were present in the United States. Approximate if you do not know.

10. Immigration Status: Check the type of immigration status that you currently hold. If you check U.S. Immigrant/Permanent Resident, holder of a “green”

card, you may proceed to the bottom of the form. Sign and date.

11. Immigration Status for J-1: Check the appropriate J-1 subtype.

12. What was your primary purpose for entering the U.S. in your current status? Check only one activity.

13. Actual Entry Date or Change of Status in the United States in your current immigration status. Must include month, day, and year. Approximate if you

are unsure.

14. Start Date: Must include month, day, and year. Approximate if you do not know.

15. End Date: Must include month, day, and year. Approximate if you do not know.

16. If employed by Medical university: annual salary and the first day you started working.

17. If student, check the appropriate box.

18. Are you married?: Check the appropriate box. Is your spouse in USA?: Check the appropriate box. Give number of other dependents in the USA?

19. Consultants/Self-employed Individuals: Check the appropriate box. This includes any office at any location specifically identified with you.

20. Tax residence is where you last paid taxes as a resident and can be different from legal residence. Do not include the USA.

Before any check can be issued, this form must be completed and returned to:

TAX SERVICES, CONTROLLER'S OFFICE

19 Hagood Avenue, MSC 817

Charleston, South Carolina 29425-8170

Telephone: (843) 792-5400

1

1 2

2