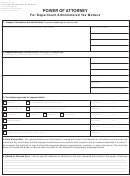

5. Added or Deleted Acts – List any specific additions or deletions to the acts otherwise in this

power of attorney:

_______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

6. Retention/Revocation of Prior Power(s) of Attorney – The filing of this power of attorney

automatically revokes all earlier power(s) of attorney on file with the City and County of Denver,

Treasury Division for the same tax matters and periods covered by this document. If you do not

want to revoke a prior power of attorney check here…………………………………..

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

7. Signature of Taxpayer(s) – If this form is not signed, dated, and titled (if applicable), it is

invalid. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver,

estate administrator, or trustee on behalf of the taxpayer, I certify that I have authority to execute

this form on behalf of taxpayer.

Signature

Date

Print Name

Title

Signature

Date

Print Name

Title

8. Declaration of Representative – I am authorized to represent the taxpayer(s) identified in

number 1 for the tax matter(s) specified.

Signature

Date

Title

I represent the taxpayer identified in number 1. as:

CO attorney, Reg # __________________

attorney registered in _____________ # ________

CO licensed CPA # __________________

CPA licensed in __________________

other, explain

_____________________________

Signature

Date

Title

I represent the taxpayer identified in number 1. as:

CO attorney, Reg # __________________

attorney registered in _____________ # ________

CO licensed CPA # __________________

CPA licensed in __________________

other, explain

_____________________________

Processing will be faster if addressed to a specific unit or person at the Treasury Division, and if

you can, attach copies of the most recent correspondence from the Treasury Division, such as

Refund Claim, Notice of Final Determination, Assessment, and Demand for Payment, Refund

Denial, Audit Engagement Letter, etc. Where the address does not specify any unit or person, this

form should be directed to City and County of Denver, Treasury Division, Tax Compliance, 201

W. Colfax Avenue, MC 1001, Dept. 1009, Denver, Colorado 80202

Page 2

1

1 2

2