Development Impact Fee Exemption Application Form - Teton County, Idaho

ADVERTISEMENT

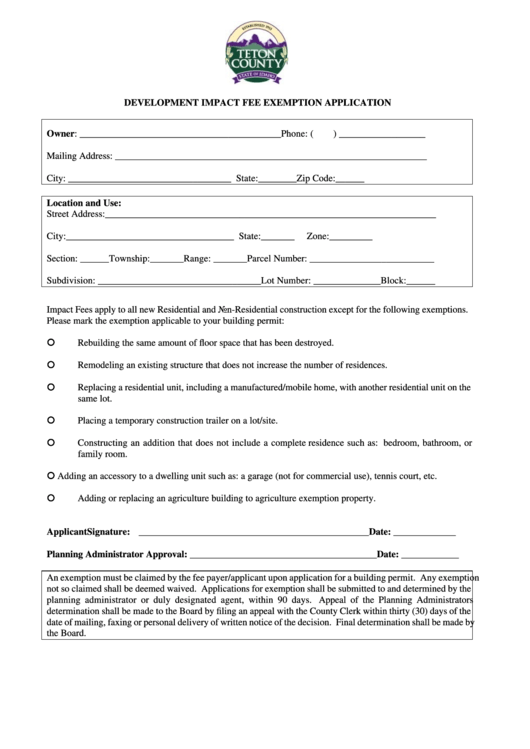

DEVELOPMENT IMPACT FEE EXEMPTION APPLICATION

Owner: __________________________________________Phone: (

) __________________

Mailing Address: _________________________________________________________________

City: __________________________________

State:________

Zip Code:______

Location and Use:

Street Address:_____________________________________________________________________

City:___________________________________

State:_______

Zone:_________

Section: ______Township: _______Range: _______Parcel Number: __________________________

Subdivision: __________________________________Lot Number: ______________Block:______

Impact Fees apply to all new Residential and Non-Residential construction except for the following exemptions.

Please mark the exemption applicable to your building permit:

Rebuilding the same amount of floor space that has been destroyed.

Remodeling an existing structure that does not increase the number of residences.

Replacing a residential unit, including a manufactured/mobile home, with another residential unit on the

same lot.

Placing a temporary construction trailer on a lot/site.

Constructing an addition that does not include a complete residence such as: bedroom, bathroom, or

family room.

Adding an accessory to a dwelling unit such as: a garage (not for commercial use), tennis court, etc.

Adding or replacing an agriculture building to agriculture exemption property.

Applicant Signature: ________________________________________________ Date: _____________

Planning Administrator Approval: _______________________________________Date: ____________

An exemption must be claimed by the fee payer/applicant upon application for a building permit. Any exemption

not so claimed shall be deemed waived. Applications for exemption shall be submitted to and determined by the

planning administrator or duly designated agent, within 90 days. Appeal of the Planning Administrators

determination shall be made to the Board by filing an appeal with the County Clerk within thirty (30) days of the

date of mailing, faxing or personal delivery of written notice of the decision. Final determination shall be made by

the Board.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1