Last Name/Surname _______________________________________________ First/Given Name ________________________________

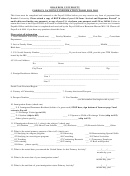

Section C – Visa Type Activity in the Last Six Calendar Years (Substantial Presence Test)

(19) List the original date (the very first date) of your entry to the United States:

________/________/________

month

day

year

(20) List the start and end date of your current purpose or program activity as indicated by your visa type

(i.e., I-20, DS-2019, I-797, etc.)

________/________/________

:

________/________/________

Check if I-94 is marked

Start Date:

End Date

as “

Duration of Stay”

month

day

year

month

day

year

(21) Visa Type History – enter your visits to the US for the last six calendar years. For F, J, M or Q status visits, list your visa type

history since January 1, 1985. Attach an additional schedule if need be. **Note – also include status change dates if you

remained in the U.S. while changing status.

Date of Entry

Date of Exit

Visa

Country of

Did you take any

to U.S. **

from U.S. **

Visa Type

Number

Primary Purpose or Activity

Tax Residence

Treaty Benefits?

Yes

No

/

/

/

/

Yes

No

/

/

/

/

Yes

No

/

/

/

/

Yes

No

/

/

/

/

Yes

No

/

/

/

/

/

/

/

/

Yes

No

Yes

No

/

/

/

/

Yes

No

/

/

/

/

/

/

/

/

Yes

No

Section D – Tax Treaty Exemption Information / IRS Forms 8233 and W-9

You must have a Social Security Number and sign an approved treaty exemption form to qualify for tax treaty benefits.

Payments to nonresident aliens for services performed in the U.S. may be subject to federal and state withholding taxes. If you believe you

may qualify for a tax treaty exemption, additional forms (IRS Form 8233 or IRS Form W-9) must be signed and dated by you and the

Withholding Acceptance Agent in Payroll Services. This can take place only after you complete the “Foreign National Information Form”.

Alert Payroll Services if you believe you qualify. Payroll Services determine eligibility.

IRS Form 8233 is used by nonresident aliens to claim exemption from withholding of taxes on compensation. The exemption must be based

on a tax treaty to which the United States is a party. Payroll Services will determine if the payee is eligible for the exemption per IRS

regulations and University administrative procedures. Payroll Services will complete Parts I & II of the form and any applicable attachment

and apply for the exemption after you have signed the form .The form is valid for one calendar year. Make sure you coordinate with Payroll

Services to sign a new form for each year you qualify for the exemption.

IRS Form W-9 is used by nonresident aliens who are classified as resident aliens for tax purposes and qualify for treaty exemption. Refer to

Payroll Services for more information. Payroll Services prepares this form if you qualify.

HOW TO COMPLETE THE FOREIGN NATIONAL INFORMATION FORM

1.

13.

Give full name as listed on your Social Security Card or as listed in your

List your current passport number.

14.

passport if you have not yet received a Social Security Card.

List the country that issued your passport (not the country where obtained).

2.

List the number on your Social Security Card as issued to you by the Social

and country of citizenship.

15.

Security Administration.

List the 10-digit number on your I-94 card (white card in your passport).

3.

16.

Enter your Employee/Student Identification Number.

Indicate your marital status.

4.

17.

Enter the date of your birth

If applicable, indicate your spouse’s work status and number of dependent

5.

List your current home address in the United States.

children in the US.

6.

18.

List your non-US home address.

If applicable to you, check correct box and list days at locations specifically

7.

Give your US home telephone number.

identified with you.

8.

19.

Write your email address. If none, write “none”.

Give the date you first entered the United States.

20.

9.

Select the category of visa you currently hold.

List the program dates of your current immigration status.

10.

21.

Write the full name of the company/institute that is sponsoring your U.S. stay.

Account for your US visits and list the visa and purpose for your stay (The

11.

Select a purpose or give a reason for your stay in the U.S.

visa number is listed in your passport – The red number stamped on your

12.

If you are s student, list the type.

US visa).

Section E - Certification

I certify that all of the above information is true and correct. I understand that if my “Passport and Visa Information” or “Residence Status

for Tax Purposes” changes, I must submit a new Foreign National Information Form reflecting the changes to: Rowan University Payroll

Services, 201 Mullica Hill Rd, Glassboro, NJ, 08028 or email milliganc@rowan.edu.

Signature________________________________________________________ Date ___________________________________

Form FNIF (07/10/08)

2

1

1 2

2