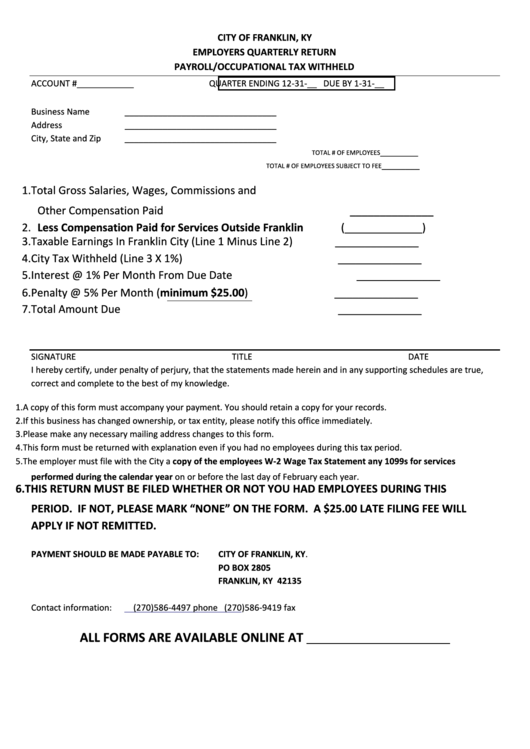

CITY OF FRANKLIN, KY

EMPLOYERS QUARTERLY RETURN

PAYROLL/OCCUPATIONAL TAX WITHHELD

ACCOUNT #____________

QUARTER ENDING 12‐31‐__ DUE BY 1‐31‐__

Business Name

________________________________

Address

________________________________

City, State and Zip

________________________________

________

TOTAL # OF EMPLOYEES

________

TOTAL # OF EMPLOYEES SUBJECT TO FEE

1. Total Gross Salaries, Wages, Commissions and

Other Compensation Paid

______________

2. Less Compensation Paid for Services Outside Franklin

(_____________)

3. Taxable Earnings In Franklin City (Line 1 Minus Line 2)

______________

4. City Tax Withheld (Line 3 X 1%)

______________

5. Interest @ 1% Per Month From Due Date

______________

6. Penalty @ 5% Per Month (minimum $25.00)

______________

7. Total Amount Due

______________

SIGNATURE

TITLE

DATE

I hereby certify, under penalty of perjury, that the statements made herein and in any supporting schedules are true,

correct and complete to the best of my knowledge.

1. A copy of this form must accompany your payment. You should retain a copy for your records.

2. If this business has changed ownership, or tax entity, please notify this office immediately.

3. Please make any necessary mailing address changes to this form.

4. This form must be returned with explanation even if you had no employees during this tax period.

5. The employer must file with the City a copy of the employees W‐2 Wage Tax Statement any 1099s for services

performed during the calendar year on or before the last day of February each year.

6. THIS RETURN MUST BE FILED WHETHER OR NOT YOU HAD EMPLOYEES DURING THIS

PERIOD. IF NOT, PLEASE MARK “NONE” ON THE FORM. A $25.00 LATE FILING FEE WILL

APPLY IF NOT REMITTED.

PAYMENT SHOULD BE MADE PAYABLE TO:

CITY OF FRANKLIN, KY.

PO BOX 2805

FRANKLIN, KY 42135

Contact information:

daniel.reetzke@franklinky.org (270)586‐4497 phone (270)586‐9419 fax

ALL FORMS ARE AVAILABLE ONLINE AT

1

1