Annual License Tax Application - City Of Paducah, Ky - 2016

ADVERTISEMENT

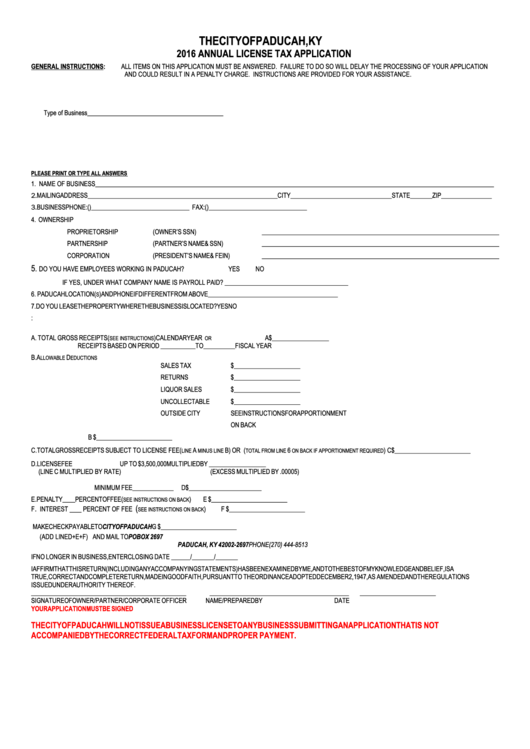

THE CITY OF PADUCAH, KY

2016 ANNUAL LICENSE TAX APPLICATION

GENERAL INSTRUCTIONS:

ALL ITEMS ON THIS APPLICATION MUST BE ANSWERED. FAILURE TO DO SO WILL DELAY THE PROCESSING OF YOUR APPLICATION

AND COULD RESULT IN A PENALTY CHARGE. INSTRUCTIONS ARE PROVIDED FOR YOUR ASSISTANCE.

Type of Business___________________________________________

PLEASE PRINT OR TYPE ALL ANSWERS

1. NAME OF BUSINESS______________________________________________________________________________________________________________________________

2. MAILING ADDRESS____________________________________________________________CITY________________________________STATE_______ ZIP________________

3. BUSINESS PHONE: (

) _______________________________ FAX: (

) _______________________________

4. OWNERSHIP

PROPRIETORSHIP

(OWNER’S SSN)

___________________________________________________________________________

PARTNERSHIP

(PARTNER’S NAME & SSN)

___________________________________________________________________________

CORPORATION

(PRESIDENT’S NAME & FEIN)

___________________________________________________________________________

5.

DO YOU HAVE EMPLOYEES WORKING IN PADUCAH?

YES

NO

IF YES, UNDER WHAT COMPANY NAME IS PAYROLL PAID? _______________________________________

6. PADUCAH LOCATION (

) AND PHONE IF DIFFERENT FROM ABOVE_________________________________________

S

7. DO YOU LEASE THE PROPERTY WHERE THE BUSINESS IS LOCATED?

YES

NO

8. CALCULATIONS:

A. TOTAL GROSS RECEIPTS (

)

CALENDAR YEAR

A$__________________

SEE INSTRUCTIONS

OR

RECEIPTS BASED ON PERIOD ___________ TO __________ FISCAL YEAR

B. A

D

LLOWABLE

EDUCTIONS

SALES TAX

$_____________________

RETURNS

$_____________________

LIQUOR SALES

$_____________________

UNCOLLECTABLE

$_____________________

OUTSIDE CITY

SEE INSTRUCTIONS FOR APPORTIONMENT

ON BACK

B $________________________

C. TOTAL GROSS RECEIPTS SUBJECT TO LICENSE FEE (

A

B) OR (

6

)

C $________________________

LINE

MINUS LINE

TOTAL FROM LINE

ON BACK IF APPORTIONMENT REQUIRED

D. LICENSE FEE

UP TO $3,500,000 MULTIPLIED BY __________________

(LINE C MULTIPLIED BY RATE)

(EXCESS MULTIPLIED BY .00005)

MINIMUM FEE _____________

D $_______________________

E. PENALTY ____ PERCENT OF FEE (

)

E $________________________

SEE INSTRUCTIONS ON BACK

.

___

(

F

INTEREST

PERCENT OF FEE

)

F $________________________

SEE INSTRUCTIONS ON BACK

G. TOTAL DUE

MAKE CHECK PAYABLE TO

CITY OF PADUCAH

G $________________________

(ADD LINE D+E+F)

AND MAIL TO

P O BOX 2697

PADUCAH, KY 42002-2697

PHONE (270) 444-8513

IF NO LONGER IN BUSINESS, ENTER CLOSING DATE

______/_______/_______

I AFFIRM THAT THIS RETURN (INCLUDING ANY ACCOMPANYING STATEMENTS) HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, IS A

TRUE, CORRECT AND COMPLETE RETURN, MADE IN GOOD FAITH, PURSUANT TO THE ORDINANCE ADOPTED DECEMBER 2, 1947, AS AMENDED AND THE REGULATIONS

ISSUED UNDER AUTHORITY THEREOF.

_________________________________________________

____________________________________________

________________________

SIGNATURE OF OWNER/PARTNER/CORPORATE OFFICER

NAME/PREPARED BY

DATE

YOUR APPLICATION MUST BE SIGNED

THE CITY OF PADUCAH WILL NOT ISSUE A BUSINESS LICENSE TO ANY BUSINESS SUBMITTING AN APPLICATION THAT IS NOT

ACCOMPANIED BY THE CORRECT FEDERAL TAX FORM AND PROPER PAYMENT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2