Multi-State Ntb Worksheet

Download a blank fillable Multi-State Ntb Worksheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Multi-State Ntb Worksheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

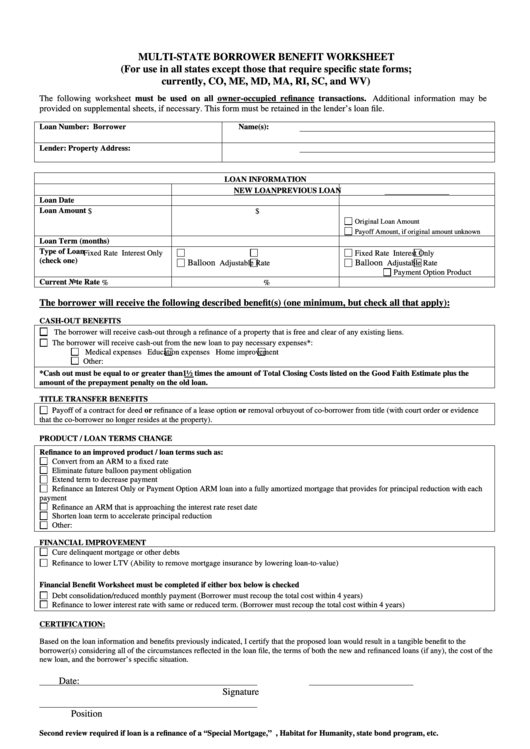

MULTI-STATE BORROWER BENEFIT WORKSHEET

(For use in all states except those that require specific state forms;

currently, CO, ME, MD, MA, RI, SC, and WV)

The following worksheet must be used on all owner-occupied refinance transactions. Additional information may be

provided on supplemental sheets, if necessary. This form must be retained in the lender’s loan file.

Loan Number:

Borrower Name(s):

Lender:

Property Address:

LOAN INFORMATION

NEW LOAN

PREVIOUS LOAN

Loan Date

Loan Amount

$

$

Original Loan Amount

Payoff Amount, if original amount unknown

Loan Term (months)

Type of Loan

Fixed Rate

Interest Only

Fixed Rate

Interest Only

(check one)

Balloon

Balloon

Adjustable Rate

Adjustable Rate

Payment Option Product

Current Note Rate

%

%

The borrower will receive the following described benefit(s) (one minimum, but check all that apply):

CASH-OUT BENEFITS

The borrower will receive cash-out through a refinance of a property that is free and clear of any existing liens.

The borrower will receive cash-out from the new loan to pay necessary expenses*:

Medical expenses

Education expenses

Home improvement

Other:

*Cash out must be equal to or greater than 1½ times the amount of Total Closing Costs listed on the Good Faith Estimate plus the

amount of the prepayment penalty on the old loan.

TITLE TRANSFER BENEFITS

Payoff of a contract for deed or refinance of a lease option or removal or buyout of co-borrower from title (with court order or evidence

that the co-borrower no longer resides at the property).

PRODUCT / LOAN TERMS CHANGE

Refinance to an improved product / loan terms such as:

Convert from an ARM to a fixed rate

Eliminate future balloon payment obligation

Extend term to decrease payment

Refinance an Interest Only or Payment Option ARM loan into a fully amortized mortgage that provides for principal reduction with each

payment

Refinance an ARM that is approaching the interest rate reset date

Shorten loan term to accelerate principal reduction

Other:

FINANCIAL IMPROVEMENT

Cure delinquent mortgage or other debts

Refinance to lower LTV (Ability to remove mortgage insurance by lowering loan-to-value)

Financial Benefit Worksheet must be completed if either box below is checked

Debt consolidation/reduced monthly payment (Borrower must recoup the total cost within 4 years)

Refinance to lower interest rate with same or reduced term. (Borrower must recoup the total cost within 4 years)

CERTIFICATION:

Based on the loan information and benefits previously indicated, I certify that the proposed loan would result in a tangible benefit to the

borrower(s) considering all of the circumstances reflected in the loan file, the terms of both the new and refinanced loans (if any), the cost of the

new loan, and the borrower’s specific situation.

Date:

Signature

Position

Second review required if loan is a refinance of a “Special Mortgage,” e.g., Habitat for Humanity, state bond program, etc.

Date:

Second Reviewer Signature

Title/Position

Correspondent Multi-State Borrower Benefit Worksheet

Page 1

3/1/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2