Payout Change Form

Download a blank fillable Payout Change Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Payout Change Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

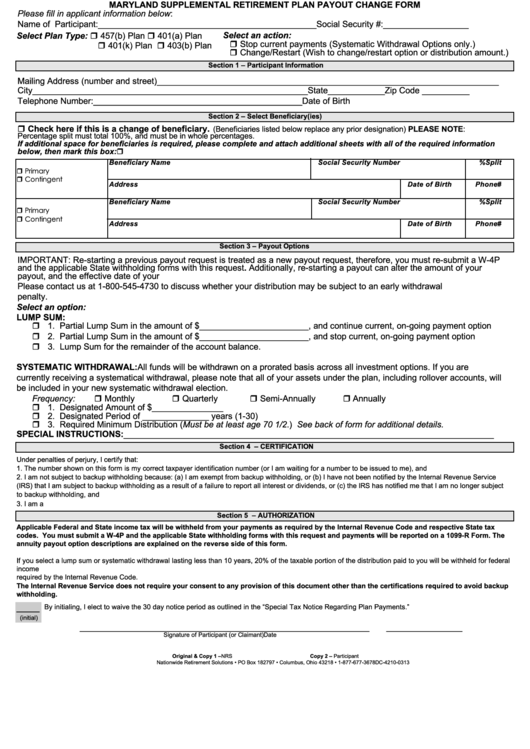

MARYLAND SUPPLEMENTAL RETIREMENT PLAN PAYOUT CHANGE FORM

Please fill in applicant information below:

Name of Participant: ______________________________________________

Social Security #:

__________________

r 457(b) Plan r 401(a) Plan

Select an action:

Select Plan Type:

r Stop current payments (Systematic Withdrawal Options only.)

r 401(k) Plan r 403(b) Plan

r Change/Restart (Wish to change/restart option or distribution amount.)

Section 1 – Participant Information

Mailing Address (number and street) ________________________________________________________________________

City __________________________________________________________

State____________

Zip Code __________

Telephone Number: ____________________________________________

Date of Birth

Section 2 – Select Beneficiary(ies)

.

r Check here if this is a change of beneficiary

(Beneficiaries listed below replace any prior designation) PLEASE NOTE:

Percentage split must total 100%, and must be in whole percentages.

If additional space for beneficiaries is required, please complete and attach additional sheets with all of the required information

below, then mark this box: r

Beneficiary Name

Social Security Number

%Split

r Primary

r Contingent

Address

Date of Birth

Phone#

Beneficiary Name

Social Security Number

%Split

r Primary

r Contingent

Address

Date of Birth

Phone#

Section 3 – Payout Options

IMPORTANT: Re-starting a previous payout request is treated as a new payout request, therefore, you must re-submit a W-4P

and the applicable State withholding forms with this request. Additionally, re-starting a payout can alter the amount of your

payout, and the effective date of your payout. Rollovers into your NRS 457 account are held in a different account.

Please contact us at 1-800-545-4730 to discuss whether your distribution may be subject to an early withdrawal

penalty.

Select an option:

LUMP SUM:

r 1. Partial Lump Sum in the amount of $_______________________, and continue current, on-going payment option

r 2. Partial Lump Sum in the amount of $_______________________, and stop current, on-going payment option

r 3. Lump Sum for the remainder of the account balance.

SYSTEMATIC WITHDRAWAL: All funds will be withdrawn on a prorated basis across all investment options. If you are

currently receiving a systematical withdrawal, please note that all of your assets under the plan, including rollover accounts, will

be included in your new systematic withdrawal election.

r Monthly

r Quarterly

r Semi-Annually

r Annually

Frequency:

r 1. Designated Amount of $_______________

r 2. Designated Period of ______________ years (1-30)

r 3. Required Minimum Distribution (Must be at least age 70 1/2.) See back of form for additional details.

SPECIAL INSTRUCTIONS: ______________________________________________________________________________

Section 4 – CERTIFICATION

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service

(IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject

to backup withholding, and

3. I am a U.S. citizen or other U.S. person.

Section 5 – AUTHORIZATION

Applicable Federal and State income tax will be withheld from your payments as required by the Internal Revenue Code and respective State tax

codes. You must submit a W-4P and the applicable State withholding forms with this request and payments will be reported on a 1099-R Form. The

annuity payout option descriptions are explained on the reverse side of this form.

If you select a lump sum or systematic withdrawal lasting less than 10 years, 20% of the taxable portion of the distribution paid to you will be withheld for federal

income taxes. State taxes will be withheld where applicable. State and federal taxes withheld will be reported on a Form 1099-R. withheld from your payments as

required by the Internal Revenue Code.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup

withholding.

____

By initialing, I elect to waive the 30 day notice period as outlined in the “Special Tax Notice Regarding Plan Payments.”

(initial)

_____________________________________________________________

________________

Signature of Participant (or Claimant)

Date

Original & Copy 1 – NRS

Copy 2 – Participant

Nationwide Retirement Solutions • PO Box 182797 • Columbus, Ohio 43218 • 1-877-677-3678

DC-4210-0313

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2