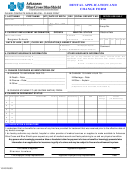

Payout Change Form Page 2

Download a blank fillable Payout Change Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Payout Change Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

MARYLAND SUPPLEMENTAL RETIREMENT PLAN

PAYOUT CHANGE OPTION DESCRIPTIONS

PARTIAL LUMP SUM PAYMENT: This option provides for a single payment in the amount requested (minimum of $25.00) from

the value of your account.

LUMP SUM PAYMENT: This option provides for the payment of the full value of your account in a single payment.

SYSTEMATIC WITHDRAWAL OPTIONS: Your account is maintained on the Administrator’s Accumulation System and

continues to earn either recurrent interest in the fixed return, or fund investment performance if in the variable return option

throughout the payout period. You will continue to receive quarterly statements. In the event of your death prior to the

exhaustion of your account, upon receipt of the claim, the beneficiary either will receive payments until the account is exhausted,

or a lump sum payment of the remaining account balance. All funds are withdrawn on a prorated basis.

DESIGNATED AMOUNT: This option provides for payments of the designated amount (minimum of $25.00) until your

account is exhausted. The final payment will be the balance of your account. Please indicate the amount to be paid, your

beneficiaries, their relationships to you, their Social Security numbers, and their birth dates.

Exchanges are permitted, subject to annual exchange limitations.

For example:

Participant dies prior to the exhaustion of the account.

–– Upon their claim, the beneficiary receives payments until the account is exhausted or a lump sum payment of

the remaining account balance.

DESIGNATED PERIOD: This option allows you to choose the number of years you will receive payments. Your payment

may fluctuate if some or all of your money is invested in Mutual Fund Options. Please indicate the amount to be paid, your

beneficiaries, their relationships to you, their Social Security numbers, and their birth dates.

Exchanges are permitted, subject to annual exchange limitations.

For example:

Participant dies prior to the exhaustion of the account.

–– Upon their claim, the beneficiary receives payments until the account is exhausted or a lump sum payment of

the remaining account balance.

REQUIRED MINIMUM DISTRIBUTION: A minimum distribution of your account is required to begin when you attain age 70 1/2.

This payment option will only pay the minimum that is required to be paid to you each year. The amount that is required to be

distributed will be calculated for each distribution year in accordance with regulations under Section 401(a)(9) of the Internal

Revenue Code. The Required Minimum Distribution (RMD) will usually be different for each year because of the changes in

your account balance and the change in your life expectancy. This payment option is not available unless you have attained age

70 1/2 and your account cannot be rolled over to another

eligible retirement plan or IRA. Please indicate the amount to be paid, your beneficiaries, their relationships to you, their Social

Security numbers, and their birth dates

For example:

Participant dies prior to the exhaustion of the account.

–– Beneficiary receives payments until the account is exhausted or a lump sum payment of the remaining account

balance.

Nationwide Retirement Solutions • PO Box 182797 • Columbus, Ohio 43218 • 1-877-677-3678

DC-4210-0313

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2