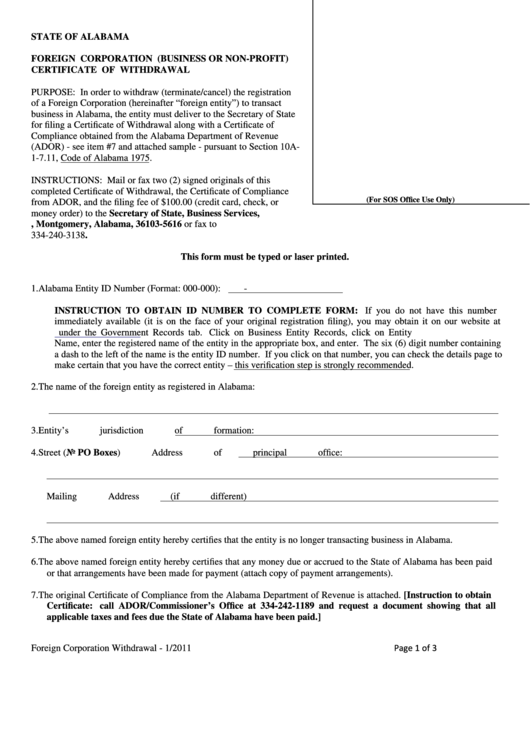

STATE OF ALABAMA

FOREIGN CORPORATION (BUSINESS OR NON-PROFIT)

CERTIFICATE OF WITHDRAWAL

PURPOSE: In order to withdraw (terminate/cancel) the registration

of a Foreign Corporation (hereinafter “foreign entity”) to transact

business in Alabama, the entity must deliver to the Secretary of State

for filing a Certificate of Withdrawal along with a Certificate of

Compliance obtained from the Alabama Department of Revenue

(ADOR) - see item #7 and attached sample - pursuant to Section 10A-

1-7.11, Code of Alabama 1975.

INSTRUCTIONS: Mail or fax two (2) signed originals of this

completed Certificate of Withdrawal, the Certificate of Compliance

(For SOS Office Use Only)

from ADOR, and the filing fee of $100.00 (credit card, check, or

money order) to the Secretary of State, Business Services,

P.O. Box 5616, Montgomery, Alabama, 36103-5616 or fax to

334-240-3138.

This form must be typed or laser printed.

1. Alabama Entity ID Number (Format: 000-000):

-

INSTRUCTION TO OBTAIN ID NUMBER TO COMPLETE FORM: If you do not have this number

immediately available (it is on the face of your original registration filing), you may obtain it on our website at

under the Government Records tab. Click on Business Entity Records, click on Entity

Name, enter the registered name of the entity in the appropriate box, and enter. The six (6) digit number containing

a dash to the left of the name is the entity ID number. If you click on that number, you can check the details page to

make certain that you have the correct entity – this verification step is strongly recommended.

2. The name of the foreign entity as registered in Alabama:

3. Entity’s jurisdiction of formation:

4. Street (No PO Boxes) Address of principal office:

Mailing Address (if different)

5. The above named foreign entity hereby certifies that the entity is no longer transacting business in Alabama.

6. The above named foreign entity hereby certifies that any money due or accrued to the State of Alabama has been paid

or that arrangements have been made for payment (attach copy of payment arrangements).

7. The original Certificate of Compliance from the Alabama Department of Revenue is attached. [Instruction to obtain

Certificate: call ADOR/Commissioner’s Office at 334-242-1189 and request a document showing that all

applicable taxes and fees due the State of Alabama have been paid.]

Page 1 of 3

Foreign Corporation Withdrawal - 1/2011

1

1 2

2 3

3