Form Rpd-41357 - Oil And Gas Proceeds Remittee'S Quarterly Tax Payment Form - New Mexico Taxation And Revenue Department

ADVERTISEMENT

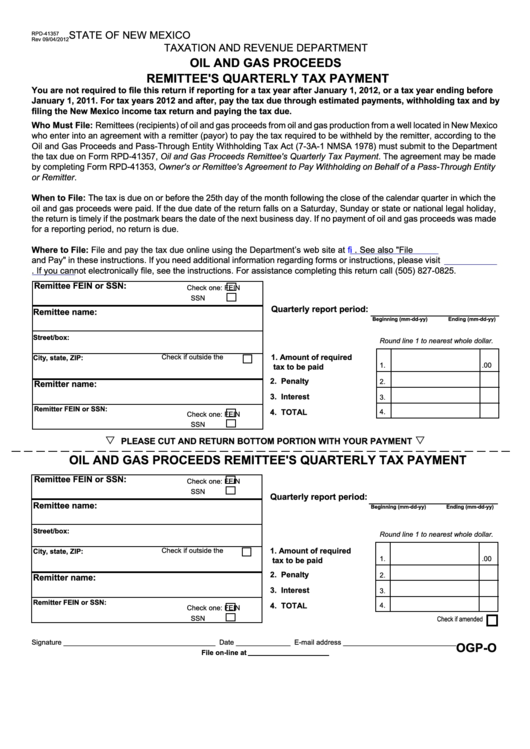

STATE OF NEW MEXICO

RPD-41357

Rev 09/04/2012

TAXATION AND REVENUE DEPARTMENT

OIL AND GAS PROCEEDS

REMITTEE'S QUARTERLY TAX PAYMENT

You are not required to file this return if reporting for a tax year after January 1, 2012, or a tax year ending before

January 1, 2011. For tax years 2012 and after, pay the tax due through estimated payments, withholding tax and by

filing the New Mexico income tax return and paying the tax due.

Who Must File: Remittees (recipients) of oil and gas proceeds from oil and gas production from a well located in New Mexico

who enter into an agreement with a remitter (payor) to pay the tax required to be withheld by the remitter, according to the

Oil and Gas Proceeds and Pass-Through Entity Withholding Tax Act (7-3A-1 NMSA 1978) must submit to the Department

the tax due on Form RPD-41357, Oil and Gas Proceeds Remittee's Quarterly Tax Payment. The agreement may be made

by completing Form RPD-41353, Owner's or Remittee's Agreement to Pay Withholding on Behalf of a Pass-Through Entity

or Remitter.

When to File: The tax is due on or before the 25th day of the month following the close of the calendar quarter in which the

oil and gas proceeds were paid. If the due date of the return falls on a Saturday, Sunday or state or national legal holiday,

the return is timely if the postmark bears the date of the next business day. If no payment of oil and gas proceeds was made

for a reporting period, no return is due.

Where to File: File and pay the tax due online using the Department’s web site at https://efile.state.nm.us. See also "File

and Pay" in these instructions. If you need additional information regarding forms or instructions, please visit

mexico.gov. If you cannot electronically file, see the instructions. For assistance completing this return call (505) 827-0825.

Remittee FEIN or SSN:

Check one:

FEIN

SSN

Quarterly report period:

Remittee name:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

Street/box:

Round line 1 to nearest whole dollar.

1. Amount of required

Check if outside the U.S.

City, state, ZIP:

1.

.00

tax to be paid

2. Penalty

2.

Remitter name:

3. Interest

3.

Remitter FEIN or SSN:

4. TOTAL

4.

Check one:

FEIN

SSN

PLEASE CUT AND RETURN BOTTOM PORTION WITH YOUR PAYMENT

OIL AND GAS PROCEEDS REMITTEE'S QUARTERLY TAX PAYMENT

Remittee FEIN or SSN:

Check one:

FEIN

SSN

Quarterly report period:

Remittee name:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

Street/box:

Round line 1 to nearest whole dollar.

1. Amount of required

Check if outside the U.S.

City, state, ZIP:

1.

.00

tax to be paid

2. Penalty

2.

Remitter name:

3. Interest

3.

Remitter FEIN or SSN:

4. TOTAL

4.

Check one:

FEIN

SSN

Check if amended

Signature _______________________________________ Date ______________ E-mail address _____________________________

OGP-O

File on-line at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1