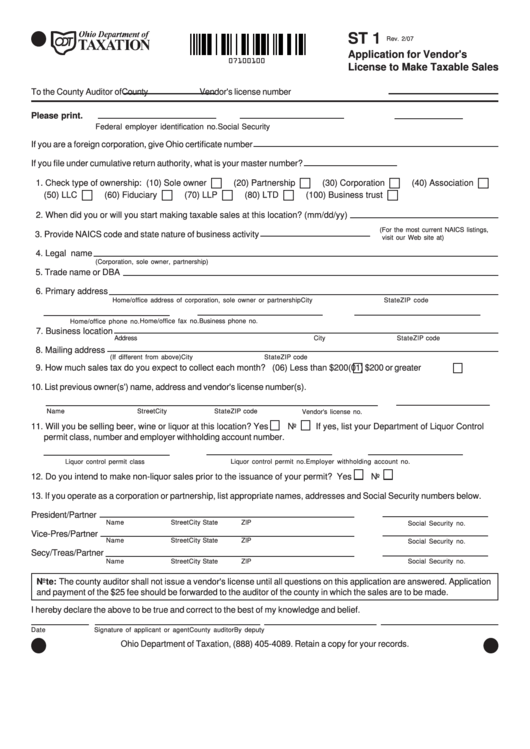

Reset Form

ST 1

Rev. 2/07

Application for Vendor's

07100100

License to Make Taxable Sales

To the County Auditor of

County

Vendor's license number

Please print.

Federal employer identification no.

Social Security no.

Ohio corporate charter no.

If you are a foreign corporation, give Ohio certificate number

If you file under cumulative return authority, what is your master number?

1. Check type of ownership: (10) Sole owner

(20) Partnership

(30) Corporation

(40) Association

(50) LLC

(60) Fiduciary

(70) LLP

(80) LTD

(100) Business trust

2. When did you or will you start making taxable sales at this location? (mm/dd/yy)

(For the most current NAICS listings,

3. Provide NAICS code and state nature of business activity

visit our Web site at tax.ohio.gov.)

4. Legal name

(Corporation, sole owner, partnership)

5. Trade name or DBA

6. Primary address

Home/office address of corporation, sole owner or partnership

City

State

ZIP code

Home/office fax no.

Business phone no.

Home/office phone no.

7. Business location

Address

City

State

ZIP code

8. Mailing address

(If different from above)

City

State

ZIP code

9. How much sales tax do you expect to collect each month? (06) Less than $200

(01) $200 or greater

10. List previous owner(s') name, address and vendor's license number(s).

Name

Street

City

State

ZIP code

Vendor's license no.

11. Will you be selling beer, wine or liquor at this location? Yes

No

If yes, list your Department of Liquor Control

permit class, number and employer withholding account number.

Liquor control permit no.

Employer withholding account no.

Liquor control permit class

12. Do you intend to make non-liquor sales prior to the issuance of your permit? Yes

No

13. If you operate as a corporation or partnership, list appropriate names, addresses and Social Security numbers below.

President/Partner

Name

Street

City

State

ZIP

Social Security no.

Vice-Pres/Partner

Name

Street

City

State

ZIP

Social Security no.

Secy/Treas/Partner

Name

Street

City

State

ZIP

Social Security no.

Note: The county auditor shall not issue a vendor's license until all questions on this application are answered. Application

and payment of the $25 fee should be forwarded to the auditor of the county in which the sales are to be made.

I hereby declare the above to be true and correct to the best of my knowledge and belief.

Date

Signature of applicant or agent

County auditor

By deputy

Ohio Department of Taxation, (888) 405-4089. Retain a copy for your records.

1

1