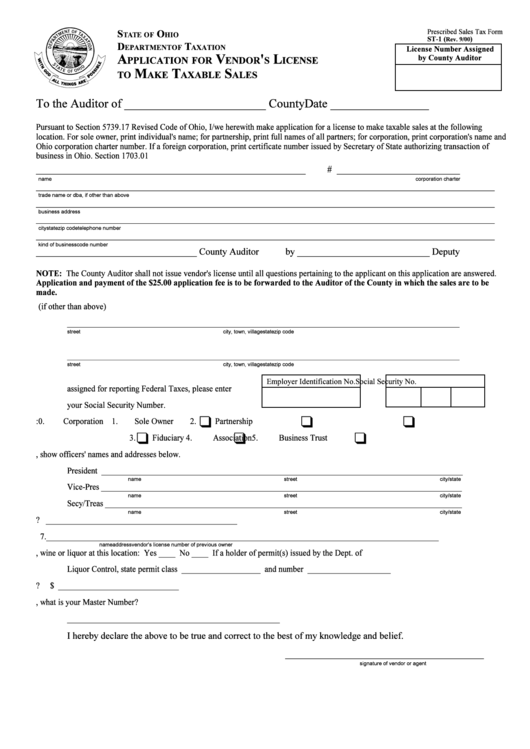

Form St-1 - Application For Vendor'S License To Make Taxable Sales - 2000

ADVERTISEMENT

S

O

Prescribed Sales Tax Form

TATE OF

HIO

ST-1 (

)

Rev. 9/00

D

T

EPARTMENT OF

AXATION

License Number Assigned

A

V

'

L

by County Auditor

PPLICATION FOR

ENDOR

S

ICENSE

M

T

S

TO

AKE

AXABLE

ALES

To the Auditor of _______________________ County

Date ________________

Pursuant to Section 5739.17 Revised Code of Ohio, I/we herewith make application for a license to make taxable sales at the following

location. For sole owner, print individual's name; for partnership, print full names of all partners; for corporation, print corporation's name and

Ohio corporation charter number. If a foreign corporation, print certificate number issued by Secretary of State authorizing transaction of

business in Ohio. Section 1703.01 O.R.C.

_________________________________________________________

# __________________________

name

corporation charter

_________________________________________________________________________________________________

trade name or dba, if other than above

_________________________________________________________________________________________________

business address

_________________________________________________________________________________________________

city

state

zip code

telephone number

_________________________________________________________________________________________________

kind of business

code number

__________________________________ County Auditor

by ____________________________ Deputy

NOTE: The County Auditor shall not issue vendor's license until all questions pertaining to the applicant on this application are answered.

Application and payment of the $25.00 application fee is to be forwarded to the Auditor of the County in which the sales are to be

made.

1.

Mailing Address (if other than above)

________________________________________________________________________________________________

street

city, town, village

state

zip code

2.

Residence Address of Vendor or Home Office of Corporation

________________________________________________________________________________________________

street

city, town, village

state

zip code

3.

Federal Employer Identification Number or if none

Employer Identification No.

Social Security No.

assigned for reporting Federal Taxes, please enter

your Social Security Number.

q

q

q

4.

Check type of ownership:

0.

Corporation

1.

Sole Owner

2.

Partnership

q

q

q

3.

Fiduciary

4.

Association

5.

Business Trust

5.

If vendor is a corporation, show officers' names and addresses below.

President ________________________________________________________________________________________

name

street

city/state

Vice-Pres ________________________________________________________________________________________

name

street

city/state

Secy/Treas _______________________________________________________________________________________

name

street

city/state

6.

When did or will you start making taxable sales at this location? ______________________________________________

7.

________________________________________________________________________________________________

name

address

vendor's license number of previous owner

8.

Will you be selling beer, wine or liquor at this location: Yes ____ No ____ If a holder of permit(s) issued by the Dept. of

Liquor Control, state permit class ___________________ and number ____________________

9.

Approximately how much sales tax do you expect to collect each month?

$ _____________________________

10.

If two or more stores are operated and you file returns under cumulative return authority, what is your Master Number?

____________________________________________________

I hereby declare the above to be true and correct to the best of my knowledge and belief.

__________________________________________

signature of vendor or agent

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1