Lodging Tax Report - City Of Chesapeake

ADVERTISEMENT

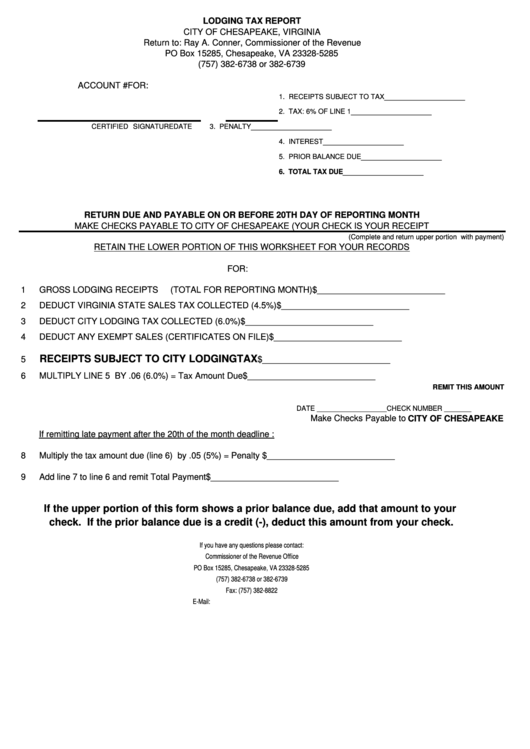

LODGING TAX REPORT

CITY OF CHESAPEAKE, VIRGINIA

Return to: Ray A. Conner, Commissioner of the Revenue

PO Box 15285, Chesapeake, VA 23328-5285

(757) 382-6738 or 382-6739

ACCOUNT #

FOR:

_________________

1. RECEIPTS SUBJECT TO TAX

_________________

2. TAX: 6% OF LINE 1

_________________

CERTIFIED SIGNATURE

DATE

3. PENALTY

_________________

4. INTEREST

_________________

5. PRIOR BALANCE DUE

_________________

6. TOTAL TAX DUE

RETURN DUE AND PAYABLE ON OR BEFORE 20TH DAY OF REPORTING MONTH

MAKE CHECKS PAYABLE TO CITY OF CHESAPEAKE (YOUR CHECK IS YOUR RECEIPT

(Complete and return upper portion with payment)

RETAIN THE LOWER PORTION OF THIS WORKSHEET FOR YOUR RECORDS

FOR:

1

GROSS LODGING RECEIPTS

(TOTAL FOR REPORTING MONTH)

$___________________________

2

DEDUCT VIRGINIA STATE SALES TAX COLLECTED (4.5%)

$___________________________

3

DEDUCT CITY LODGING TAX COLLECTED (6.0%)

$___________________________

4

DEDUCT ANY EXEMPT SALES (CERTIFICATES ON FILE)

$___________________________

RECEIPTS SUBJECT TO CITY LODGINGTAX

5

$___________________________

6

MULTIPLY LINE 5 BY .06 (6.0%) = Tax Amount Due

$___________________________

REMIT THIS AMOUNT

DATE __________________

CHECK NUMBER _______

Make Checks Payable to CITY OF CHESAPEAKE

If remitting late payment after the 20th of the month deadline :

8

Multiply the tax amount due (line 6) by .05 (5%) = Penalty

$___________________________

9

Add line 7 to line 6 and remit Total Payment

$___________________________

If the upper portion of this form shows a prior balance due, add that amount to your

check. If the prior balance due is a credit (-), deduct this amount from your check.

If you have any questions please contact:

Commissioner of the Revenue Office

PO Box 15285, Chesapeake, VA 23328-5285

(757) 382-6738 or 382-6739

Fax: (757) 382-8822

E-Mail: bustax@comrev.city.chesapeake.va.us

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1