Lodging Tax Form - City Of Petersburg

ADVERTISEMENT

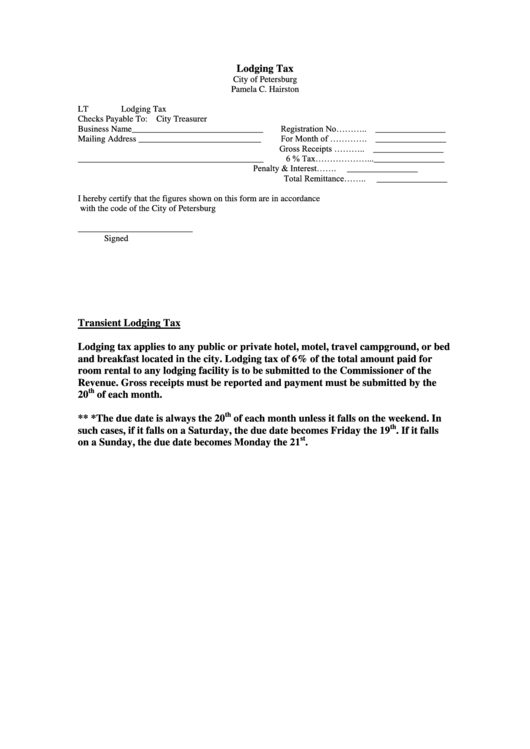

Lodging Tax

City of Petersburg

Pamela C. Hairston

LT

Lodging Tax

Checks Payable To: City Treasurer

Registration No……….. ________________

Business Name______________________________

For Month of …………. ________________

Mailing Address ____________________________

Gross Receipts ……….. ________________

6 % Tax………………... ________________

__________________________________________

Penalty & Interest…….

________________

Total Remittance……..

________________

I hereby certify that the figures shown on this form are in accordance

with the code of the City of Petersburg

__________________________

Signed

Transient Lodging Tax

Lodging tax applies to any public or private hotel, motel, travel campground, or bed

and breakfast located in the city. Lodging tax of 6% of the total amount paid for

room rental to any lodging facility is to be submitted to the Commissioner of the

Revenue. Gross receipts must be reported and payment must be submitted by the

th

20

of each month.

th

** *The due date is always the 20

of each month unless it falls on the weekend. In

th

such cases, if it falls on a Saturday, the due date becomes Friday the 19

. If it falls

st

on a Sunday, the due date becomes Monday the 21

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2