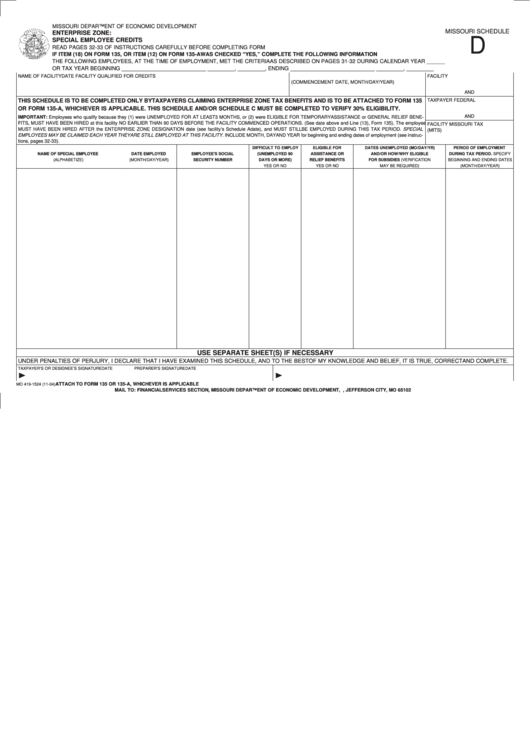

Form Mo 419-1524 - Missouri Schedule D - Enterprise Zone: Special Employee Credits

ADVERTISEMENT

MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT

MISSOURI SCHEDULE

ENTERPRISE ZONE:

D

SPECIAL EMPLOYEE CREDITS

READ PAGES 32-33 OF INSTRUCTIONS CAREFULLY BEFORE COMPLETING FORM

IF ITEM (18) ON FORM 135, OR ITEM (12) ON FORM 135-A WAS CHECKED “YES,” COMPLETE THE FOLLOWING INFORMATION

S

THE FOLLOWING EMPLOYEES, AT THE TIME OF EMPLOYMENT, MET THE CRITERIA AS DESCRIBED ON PAGES 31-32 DURING CALENDAR YEAR ______

OR TAX YEAR BEGINNING ____________________________ _________, _________, ENDING ____________________________ _________, _________

NAME OF FACILITY

DATE FACILITY QUALIFIED FOR CREDITS

FACILITY FEDERAL I.D. NO.

(COMMENCEMENT DATE, MONTH/DAY/YEAR)

AND

THIS SCHEDULE IS TO BE COMPLETED ONLY BY TAXPAYERS CLAIMING ENTERPRISE ZONE TAX BENEFITS AND IS TO BE ATTACHED TO FORM 135

TAXPAYER FEDERAL I.D. NO.

OR FORM 135-A, WHICHEVER IS APPLICABLE. THIS SCHEDULE AND/OR SCHEDULE C MUST BE COMPLETED TO VERIFY 30% ELIGIBILITY.

AND

IMPORTANT: Employees who qualify because they (1) were UNEMPLOYED FOR AT LEAST 3 MONTHS, or (2) were ELIGIBLE FOR TEMPORARY ASSISTANCE or GENERAL RELIEF BENE-

FITS, MUST HAVE BEEN HIRED at this facility NO EARLIER THAN 90 DAYS BEFORE THE FACILITY COMMENCED OPERATIONS. (See date above and Line (13), Form 135). The employee

FACILITY MISSOURI TAX I.D. NO.

MUST HAVE BEEN HIRED AFTER the ENTERPRISE ZONE DESIGNATION date (see facility’s Schedule A date), and MUST STILL BE EMPLOYED DURING THIS TAX PERIOD. SPECIAL

(MITS)

EMPLOYEES MAY BE CLAIMED EACH YEAR THEY ARE STILL EMPLOYED AT THIS FACILITY. INCLUDE MONTH, DAY AND YEAR for beginning and ending dates of employment (see instruc-

tions, pages 32-33).

DIFFICULT TO EMPLOY

ELIGIBLE FOR

DATES UNEMPLOYED (MO/DAY/YR)

PERIOD OF EMPLOYMENT

NAME OF SPECIAL EMPLOYEE

DATE EMPLOYED

EMPLOYEE’S SOCIAL

(UNEMPLOYED 90

ASSISTANCE OR

AND/OR HOW/WHY ELIGIBLE

DURING TAX PERIOD. SPECIFY

(ALPHABETIZE)

(MONTH/DAY/YEAR)

SECURITY NUMBER

DAYS OR MORE)

RELIEF BENEFITS

FOR SUBSIDIES (VERIFICATION

BEGINNING AND ENDING DATES

YES OR NO

YES OR NO

MAY BE REQUIRED)

(MONTH/DAY/YEAR)

USE SEPARATE SHEET(S) IF NECESSARY

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS SCHEDULE, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, IT IS TRUE, CORRECT AND COMPLETE.

TAXPAYER’S OR DESIGNEE’S SIGNATURE

DATE

PREPARER’S SIGNATURE

DATE

❿

❿

ATTACH TO FORM 135 OR 135-A, WHICHEVER IS APPLICABLE

MO 419-1524 (11-04)

MAIL TO: FINANCIAL SERVICES SECTION, MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT, P.O. BOX 118, JEFFERSON CITY, MO 65102

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1