Tax Report Form - City Of Auburn, Alabama

ADVERTISEMENT

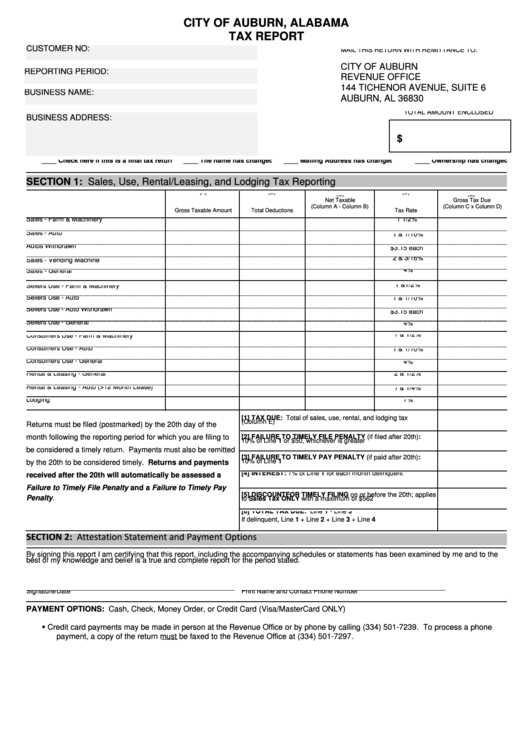

CITY OF AUBURN, ALABAMA

TAX REPORT

CUSTOMER NO:

MAIL THIS RETURN WITH REMITTANCE TO:

CITY OF AUBURN

REPORTING PERIOD:

REVENUE OFFICE

144 TICHENOR AVENUE, SUITE 6

BUSINESS NAME:

AUBURN, AL 36830

TOTAL AMOUNT ENCLOSED

BUSINESS ADDRESS:

$

____ Check here if this is a final tax return

____ Ownership has changed

____ The name has changed

____ Mailing Address has changed

SECTION 1: Sales, Use, Rental/Leasing, and Lodging Tax Reporting

(A)

(B)

(D)

(C)

(E)

Net Taxable

Gross Tax Due

(Column A - Column B)

(Column C x Column D)

Gross Taxable Amount

Total Deductions

Tax Rate

Sales - Farm & Machinery

Type of Tax/Tax Area

1 1/2%

Sales - Auto

1 & 1/10%

Autos Withdrawn

$3.15 each

2 & 3/16%

Sales - Vending Machine

4%

Sales - General

1 &1/2%

Sellers Use - Farm & Machinery

Sellers Use - Auto

1 & 1/10%

Sellers Use - Auto Withdrawn

$3.15 each

Sellers Use - General

4%

1 & 1/2%

Consumers Use - Farm & Machinery

Consumers Use - Auto

1 & 1/10%

Consumers Use - General

4%

Rental & Leasing - General

2 & 1/2%

Rental & Leasing - Auto (>12 Month Lease)

1 & 1/4%

Lodging

7%

[1] TAX DUE: Total of sales, use, rental, and lodging tax

Returns must be filed (postmarked) by the 20th day of the

(Column E)

month following the reporting period for which you are filing to

[2] FAILURE TO TIMELY FILE PENALTY (if filed after 20th):

10% of Line 1 or $50, whichever is greater

be considered a timely return. Payments must also be remitted

[3] FAILURE TO TIMELY PAY PENALTY (if paid after 20th):

by the 20th to be considered timely. Returns and payments

10% of Line 1

received after the 20th will automatically be assessed a

[4] INTEREST: 1% of Line 1 for each month delinquent

Failure to Timely File Penalty and a Failure to Timely Pay

[5] DISCOUNT FOR TIMELY FILING on or before the 20th; applies

Penalty.

to Sales Tax ONLY with a maximum of $562

[6] TOTAL TAX DUE: Line 1 - Line 5

If delinquent, Line 1 + Line 2 + Line 3 + Line 4

SECTION 2: Attestation Statement and Payment Options

By signing this report I am certifying that this report, including the accompanying schedules or statements has been examined by me and to the

best of my knowledge and belief is a true and complete report for the period stated.

Signature/Date

Print Name and Contact Phone Number

PAYMENT OPTIONS: Cash, Check, Money Order, or Credit Card (Visa/MasterCard ONLY)

Credit card payments may be made in person at the Revenue Office or by phone by calling (334) 501-7239. To process a phone

payment, a copy of the return must be faxed to the Revenue Office at (334) 501-7297.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2